Authors

Summary

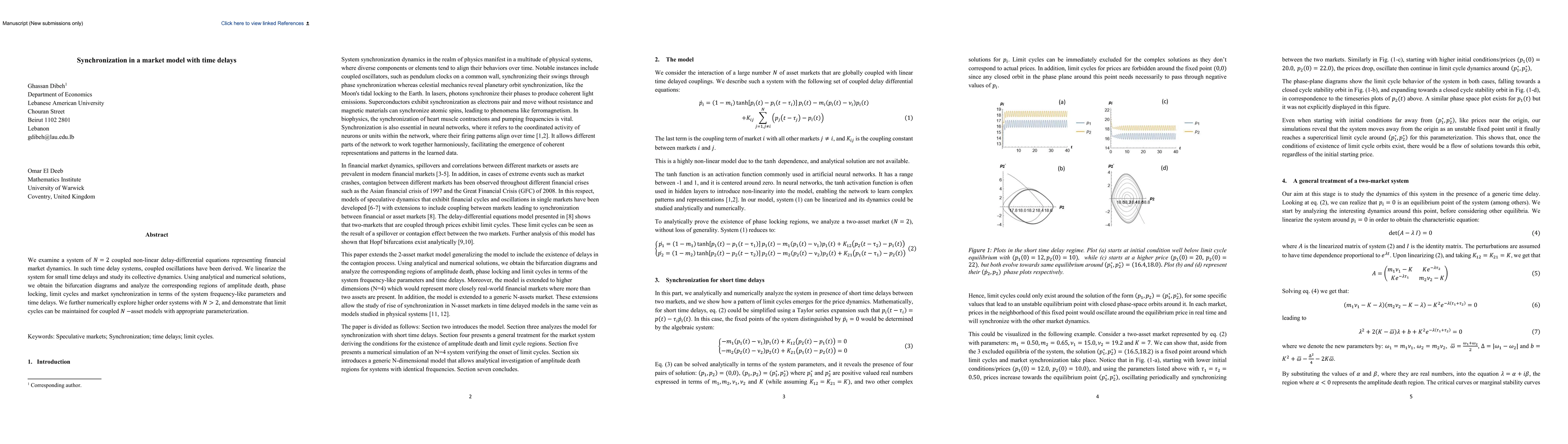

We examine a system of N=2 coupled non-linear delay-differential equations representing financial market dynamics. In such time delay systems, coupled oscillations have been derived. We linearize the system for small time delays and study its collective dynamics. Using analytical and numerical solutions, we obtain the bifurcation diagrams and analyze the corresponding regions of amplitude death, phase locking, limit cycles and market synchronization in terms of the system frequency-like parameters and time delays. We further numerically explore higher order systems with N>2, and demonstrate that limit cycles can be maintained for coupled N-asset models with appropriate parameterization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)