Summary

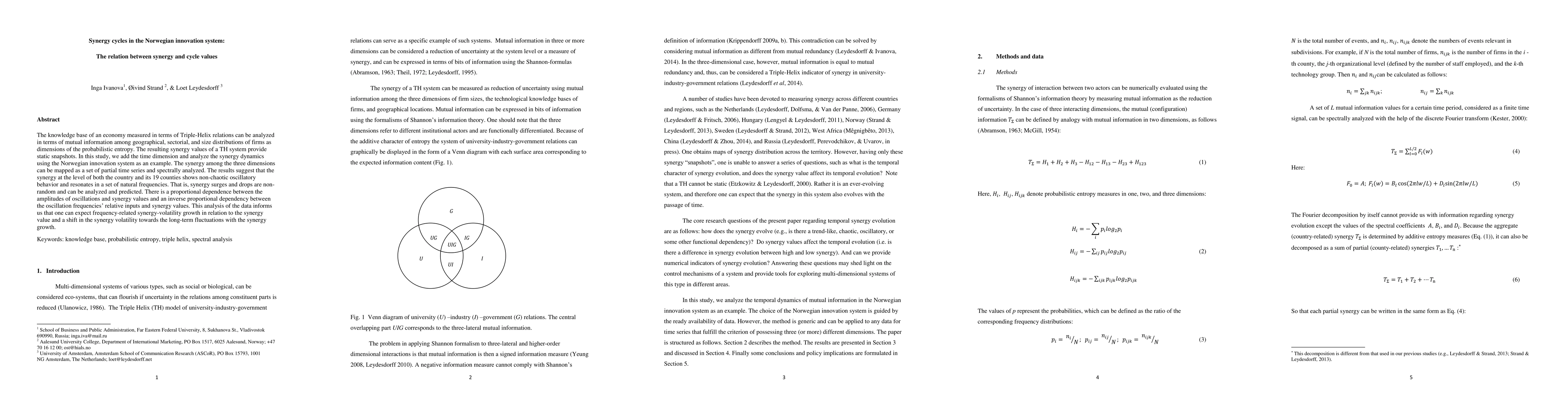

The knowledge base of an economy measured in terms of Triple Helix relations can be analyzed in terms of mutual information among geographical, sectorial, and size distributions of firms as dimensions of the probabilistic entropy. The resulting synergy values of a TH system provide static snapshots. In this study, we add the time dimension and analyze the synergy dynamics using the Norwegian innovation system as an example. The synergy among the three dimensions can be mapped as a set of partial time series and spectrally analyzed. The results suggest that the synergy at the level of both the country and its 19 counties shoe non-chaotic oscillatory behavior and resonates in a set of natural frequencies. That is, synergy surges and drops are non-random and can be analyzed and predicted. There is a proportional dependence between the amplitudes of oscillations and synergy values and an inverse proportional dependence between the oscillation frequencies' relative inputs and synergy values. This analysis of the data informs us that one can expect frequency-related synergy-volatility growth in relation to the synergy value and a shift in the synergy volatility towards the long-term fluctuations with the synergy growth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)