Authors

Summary

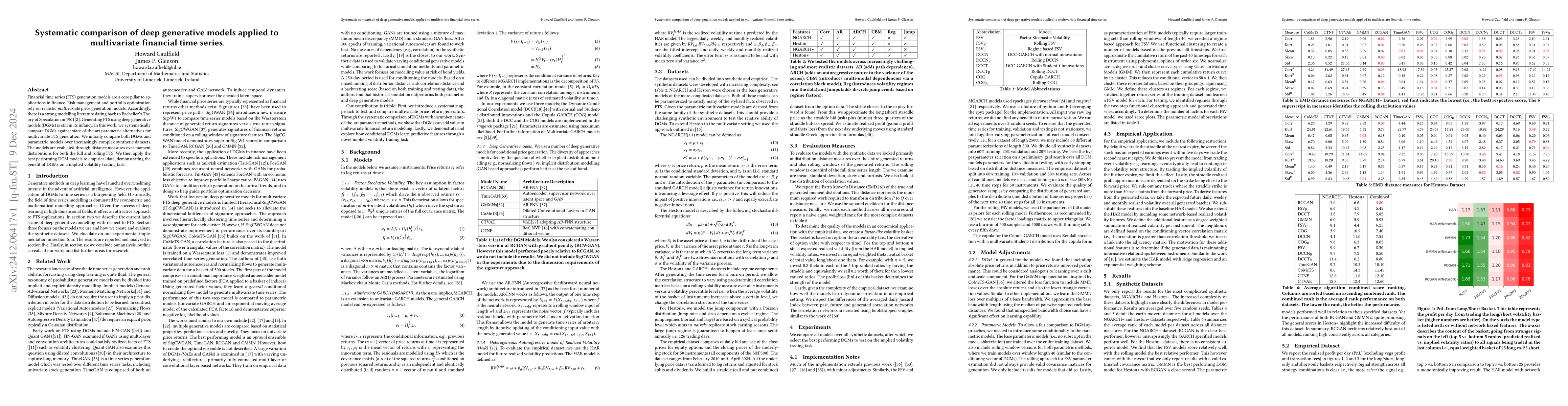

Financial time series (FTS) generation models are a core pillar to applications in finance. Risk management and portfolio optimization rely on realistic multivariate price generation models. Accordingly, there is a strong modelling literature dating back to Bachelier's Theory of Speculation in 1901. Generating FTS using deep generative models (DGMs) is still in its infancy. In this work, we systematically compare DGMs against state-of-the-art parametric alternatives for multivariate FTS generation. We initially compare both DGMs and parametric models over increasingly complex synthetic datasets. The models are evaluated through distance measures for varying distribution moments of both the full and rolling FTS. We then apply the best performing DGM models to empirical data, demonstrating the benefit of DGMs through a implied volatility trading task.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersApplication of time-series quantum generative model to financial data

Shun Okumura, Masayuki Ohzeki, Masaya Abe

No citations found for this paper.

Comments (0)