Summary

We propose a dynamic model of dependence structure between financial institutions within a financial system and we construct measures for dependence and financial instability. Employing Markov structures of joint credit migrations, our model allows for contagious simultaneous jumps in credit ratings and provides flexibility in modeling dependence structures. Another key aspect is that the proposed measures consider the interdependence and reflect the changing economic landscape as financial institutions evolve over time. In the final part, we give several examples, where we study various dependence structures and investigate their systemic instability measures. In particular, we show that subject to the same pool of Markov chains, the simulated Markov structures with distinct dependence structures generate different sequences of systemic instability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

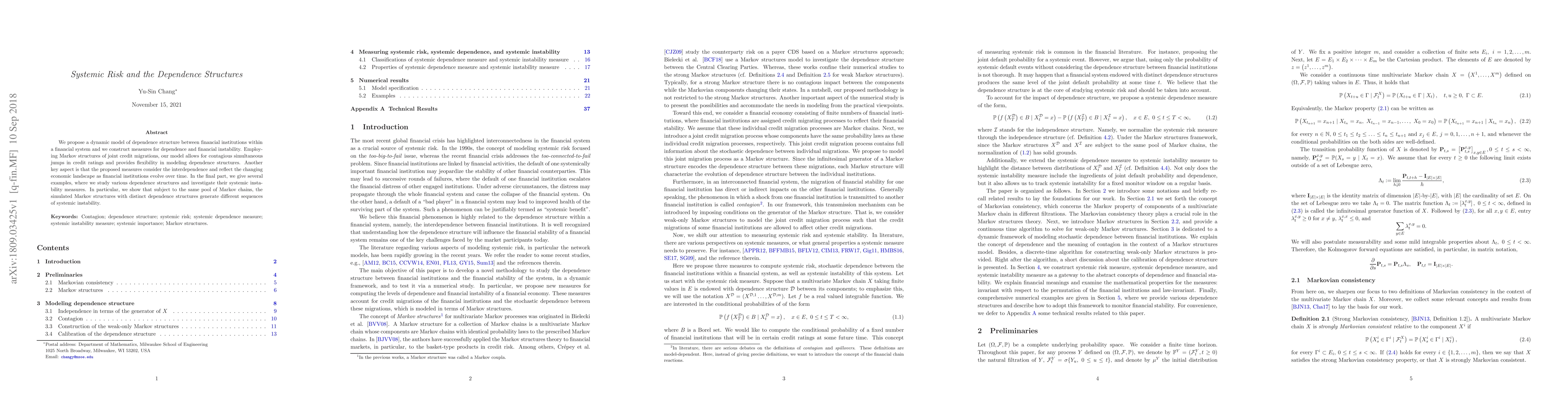

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasuring Systemic Risk: Common Factor Exposures and Tail Dependence Effects

Chih-Wei Wang, Juan Ignacio Peña, Wan-Chien Chiu

Marginal expected shortfall: Systemic risk measurement under dependence uncertainty

Jinghui Chen, X. Sheldon Lin, Edward Furman

Systemic Risk Management via Maximum Independent Set in Extremal Dependence Networks

Tiandong Wang, Qian Hui

No citations found for this paper.

Comments (0)