Summary

We propose a model for the credit and liquidity risks faced by clearing members of Central Counterparty Clearing houses (CCPs). This model aims to capture the features of: gap risk; feedback between clearing member default, market volatility and margining requirements; the different risks faced by various types of market participant and the changes in margining requirements a clearing member faces as the system evolves. By considering the entire network of CCPs and clearing members, we investigate the distribution of losses to default fund contributions and contingent liquidity requirements for each clearing member; further, we identify wrong-way risks between defaults of clearing members and market turbulence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

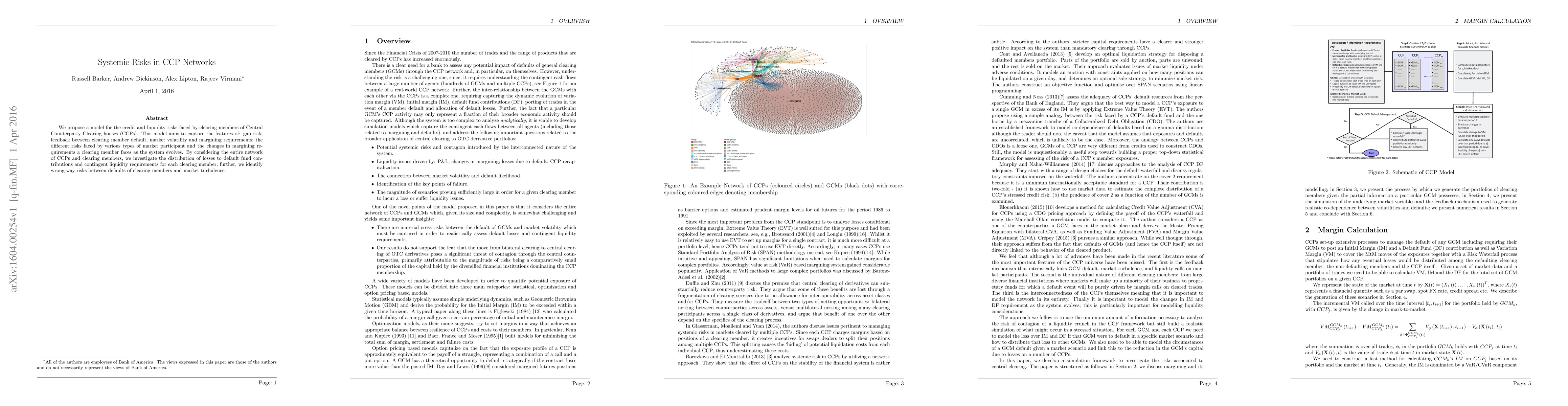

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)