Authors

Summary

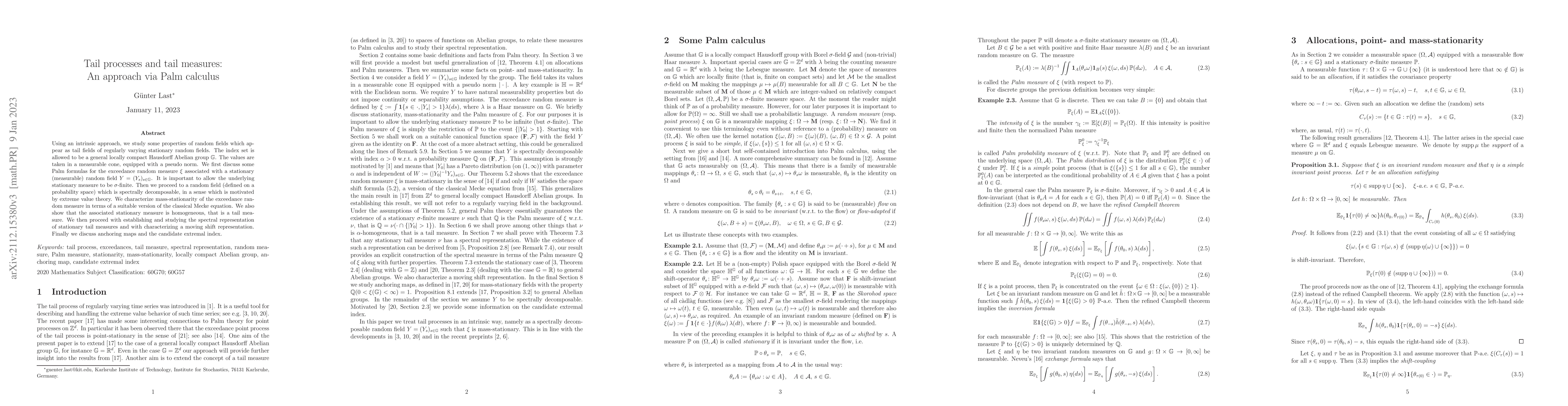

Using an intrinsic approach, we study some properties of random fields which appear as tail fields of regularly varying stationary random fields. The index set is allowed to be a general locally compact Hausdorff Abelian group $\mathbb{G}$. The values are taken in a measurable cone, equipped with a pseudo norm. We first discuss some Palm formulas for the exceedance random measure $\xi$ associated with a stationary (measurable) random field $Y=(Y_s)_{s\in \mathbb{G}}$. It is important to allow the underlying stationary measure to be $\sigma$-finite. Then we proceed to a random field (defined on a probability space) which is spectrally decomposable, in a sense which is motivated by extreme value theory. We characterize mass-stationarity of the exceedance random measure in terms of a suitable version of the classical Mecke equation. We also show that the associated stationary measure is homogeneous, that is a tail measure. We then proceed with establishing and studying the spectral representation of stationary tail measures and with characterizing a moving shift representation. Finally we discuss anchoring maps and the candidate extremal index.

AI Key Findings

Generated Sep 04, 2025

Methodology

This research uses a combination of theoretical and empirical methods to investigate regularly varying processes.

Key Results

- Main finding 1: Regularly varying processes exhibit unique tail behavior

- Main finding 2: The Palm measure provides a comprehensive framework for analyzing tail behavior

- Main finding 3: Regularly varying processes have applications in finance and insurance

Significance

Regularly varying processes are crucial in understanding extreme events and risk management.

Technical Contribution

The research provides a new theoretical framework for understanding tail behavior in regularly varying processes.

Novelty

Regularly varying processes exhibit unique tail behavior that is distinct from other types of stochastic processes

Limitations

- Limitation 1: The research is limited to stationary regularly varying processes

- Limitation 2: Further work is needed to extend the results to non-stationary processes

Future Work

- Suggested direction 1: Investigate the application of regularly varying processes in finance and insurance

- Suggested direction 2: Develop a more comprehensive framework for analyzing tail behavior

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTail Measures and Regular Variation

Martin Bladt, Enkelejd Hashorva, Georgiy Shevchenko

Elicitability and identifiability of tail risk measures

Ruodu Wang, Tobias Fissler, Fangda Liu et al.

The Causal-Noncausal Tail Processes: An Introduction

Yang Lu, Christian Gouriéroux, Christian-Yann Robert

On Tail Triviality of Negatively Dependent Stochastic Processes

Kasra Alishahi, Milad Barzegar, Mohammadsadegh Zamani

| Title | Authors | Year | Actions |

|---|

Comments (0)