Authors

Summary

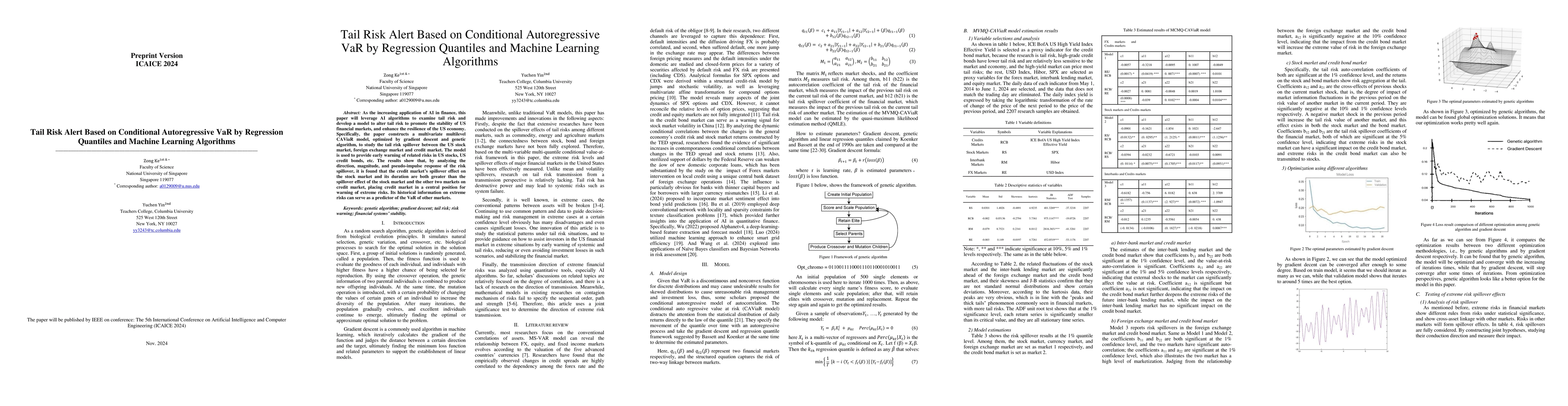

As the increasing application of AI in finance, this paper will leverage AI algorithms to examine tail risk and develop a model to alter tail risk to promote the stability of US financial markets, and enhance the resilience of the US economy. Specifically, the paper constructs a multivariate multilevel CAViaR model, optimized by gradient descent and genetic algorithm, to study the tail risk spillover between the US stock market, foreign exchange market and credit market. The model is used to provide early warning of related risks in US stocks, US credit bonds, etc. The results show that, by analyzing the direction, magnitude, and pseudo-impulse response of the risk spillover, it is found that the credit market's spillover effect on the stock market and its duration are both greater than the spillover effect of the stock market and the other two markets on credit market, placing credit market in a central position for warning of extreme risks. Its historical information on extreme risks can serve as a predictor of the VaR of other markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCAESar: Conditional Autoregressive Expected Shortfall

Fabrizio Lillo, Piero Mazzarisi, Federico Gatta

On Learning the Tail Quantiles of Driving Behavior Distributions via Quantile Regression and Flows

Wolfgang Utschick, Oliver De Candido, Philipp Geiger et al.

Distribution-free risk assessment of regression-based machine learning algorithms

Yang Li, Yuanyuan Li, Agni Orfanoudaki et al.

Expectile-based conditional tail moments with covariates

Qian Xiong, Zuoxiang Peng

| Title | Authors | Year | Actions |

|---|

Comments (0)