Summary

This paper develops a Bayesian framework for the realized exponential generalized autoregressive conditional heteroskedasticity (realized EGARCH) model, which can incorporate multiple realized volatility measures for the modelling of a return series. The realized EGARCH model is extended by adopting a standardized Student-t and a standardized skewed Student-t distribution for the return equation. Different types of realized measures, such as sub-sampled realized variance, sub-sampled realized range, and realized kernel, are considered in the paper. The Bayesian Markov chain Monte Carlo (MCMC) estimation employs the robust adaptive Metropolis algorithm (RAM) in the burn in period and the standard random walk Metropolis in the sample period. The Bayesian estimators show more favourable results than maximum likelihood estimators in a simulation study. We test the proposed models with several indices to forecast one-step-ahead Value at Risk (VaR) and Expected Shortfall (ES) over a period of 1000 days. Rigorous tail risk forecast evaluations show that the realized EGARCH models employing the standardized skewed Student-t distribution and incorporating sub-sampled realized range are favored, compared to a range of models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

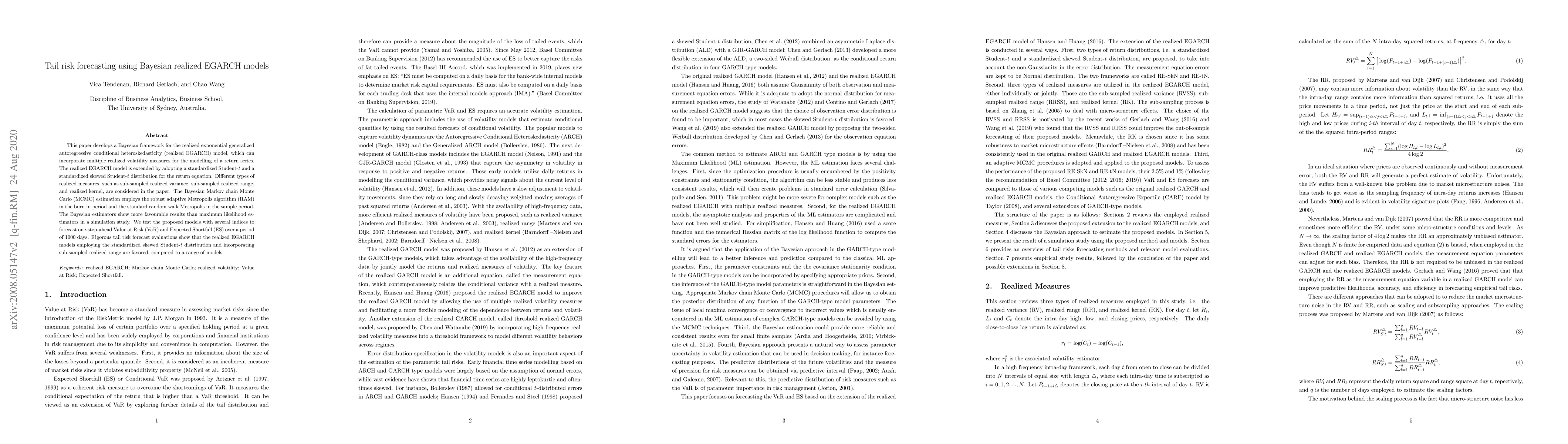

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Bayesian realized threshold measurement GARCH framework for financial tail risk forecasting

Chao Wang, Richard Gerlach

No citations found for this paper.

Comments (0)