Authors

Summary

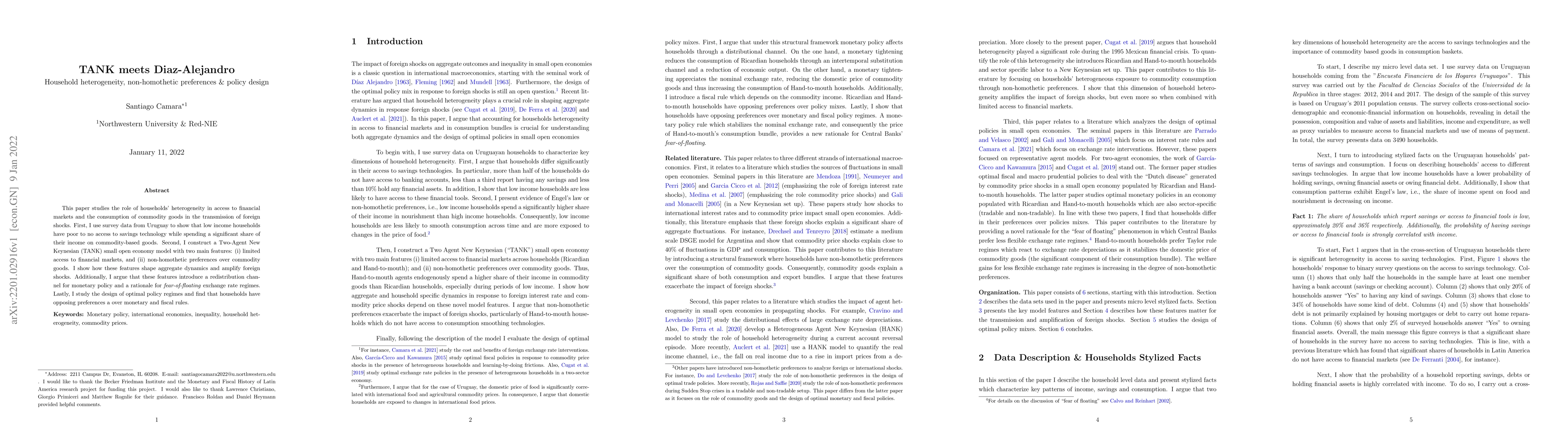

This paper studies the role of households' heterogeneity in access to financial markets and the consumption of commodity goods in the transmission of foreign shocks. First, I use survey data from Uruguay to show that low income households have poor to no access to savings technology while spending a significant share of their income on commodity-based goods. Second, I construct a Two-Agent New Keynesian (TANK) small open economy model with two main features: (i) limited access to financial markets, and (ii) non-homothetic preferences over commodity goods. I show how these features shape aggregate dynamics and amplify foreign shocks. Additionally, I argue that these features introduce a redistribution channel for monetary policy and a rationale for "fear-of-floating" exchange rate regimes. Lastly, I study the design of optimal policy regimes and find that households have opposing preferences a over monetary and fiscal rules.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)