Summary

Modern ad auctions allow advertisers to target more specific segments of the user population. Unfortunately, this is not always in the best interest of the ad platform. In this paper, we examine the following basic question in the context of second-price ad auctions: how should an ad platform optimally reveal information about the ad opportunity to the advertisers in order to maximize revenue? We consider a model in which bidders' valuations depend on a random state of the ad opportunity. Different from previous work, we focus on a more practical, and challenging, situation where the space of possible realizations of ad opportunities is extremely large. We thus focus on developing algorithms whose running time is independent of the number of ad opportunity realizations. We examine the auctioneer's algorithmic question of designing the optimal signaling scheme. When the auctioneer is restricted to send a public signal to all bidders, we focus on a well-motivated Bayesian valuation setting in which the auctioneer and bidders both have private information, and present two main results: 1. we exhibit a characterization result regarding approximately optimal schemes and prove that any constant-approximate public signaling scheme must use exponentially many signals; 2. we present a "simple" public signaling scheme that serves as a constant approximation under mild assumptions. We then initiate an exploration on the power of being able to send different signals privately to different bidders. Here we examine a basic setting where the auctioneer knows bidders' valuations, and exhibit a polynomial-time private scheme that extracts almost full surplus even in the worst Bayes Nash equilibrium. This illustrates the surprising power of private signaling schemes in extracting revenue.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

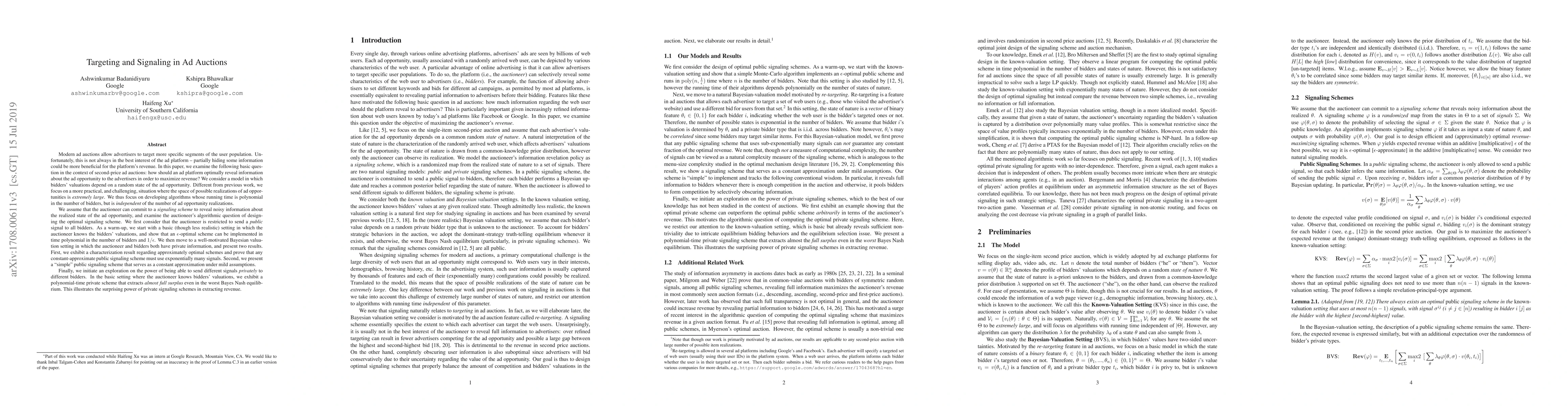

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPublic Signaling in Bayesian Ad Auctions

Nicola Gatti, Francesco Bacchiocchi, Matteo Castiglioni et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)