Authors

Summary

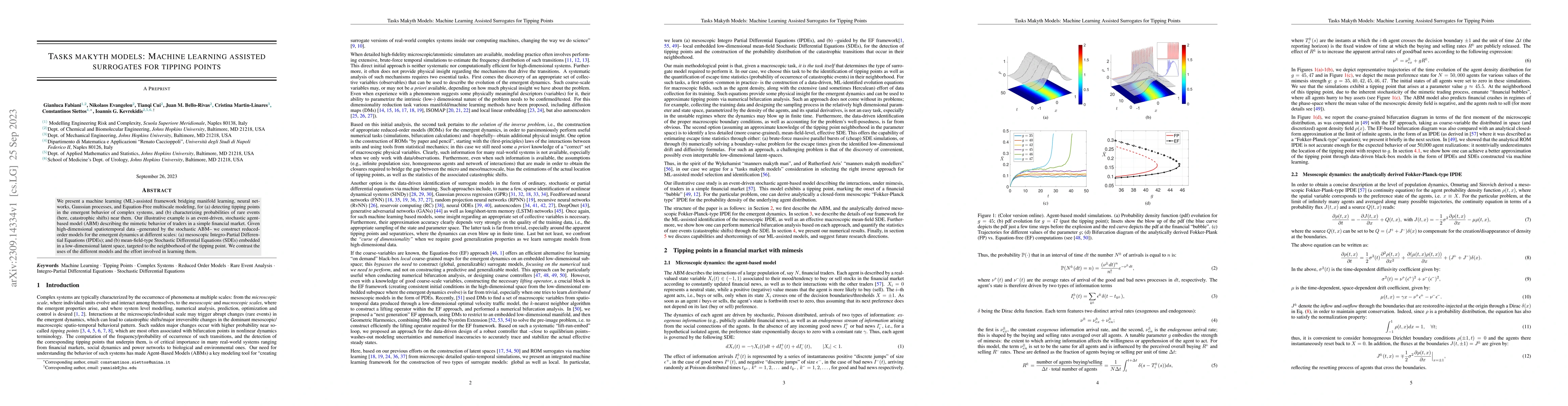

We present a machine learning (ML)-assisted framework bridging manifold learning, neural networks, Gaussian processes, and Equation-Free multiscale modeling, for (a) detecting tipping points in the emergent behavior of complex systems, and (b) characterizing probabilities of rare events (here, catastrophic shifts) near them. Our illustrative example is an event-driven, stochastic agent-based model (ABM) describing the mimetic behavior of traders in a simple financial market. Given high-dimensional spatiotemporal data -- generated by the stochastic ABM -- we construct reduced-order models for the emergent dynamics at different scales: (a) mesoscopic Integro-Partial Differential Equations (IPDEs); and (b) mean-field-type Stochastic Differential Equations (SDEs) embedded in a low-dimensional latent space, targeted to the neighborhood of the tipping point. We contrast the uses of the different models and the effort involved in learning them.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTipping Points of Evolving Epidemiological Networks: Machine Learning-Assisted, Data-Driven Effective Modeling

Ioannis G. Kevrekidis, Juan M. Bello-Rivas, Nikolaos Evangelou et al.

Deep learning for predicting the occurrence of tipping points

Wei Chen, Chengzuo Zhuge, Jiawei Li

Local surrogates for quantum machine learning

Christopher Ferrie, Sreeraj Rajindran Nair

Extrapolating tipping points and simulating non-stationary dynamics of complex systems using efficient machine learning

Christoph Räth, Daniel Köglmayr

| Title | Authors | Year | Actions |

|---|

Comments (0)