Authors

Summary

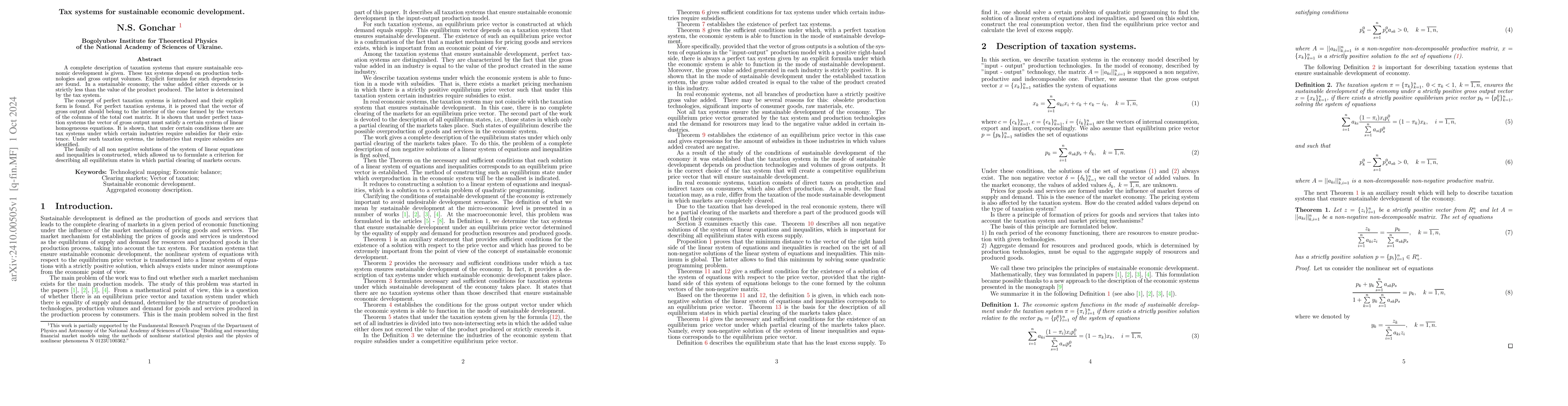

A complete description of taxation systems that ensure sustainable economic development is given. These tax systems depend on production technologies and gross output volumes. Explicit formulas for such dependencies are found. In a sustainable economy, the value added either exceeds or is strictly less than the value of the product produced. The latter is determined by the tax system. The concept of perfect taxation systems is introduced and their explicit form is found. For perfect taxation systems, it is proved that the vector of gross output should belong to the interior of the cone formed by the vectors of the columns of the total cost matrix. It is shown that under perfect taxation systems the vector of gross output must satisfy a certain system of linear homogeneous equations. It is shown, that under certain conditions there are tax systems under which certain industries require subsidies for their existence. Under such taxation systems, the industries that require subsidies are identified. The family of all non negative solutions of the system of linear equations and inequalities is constructed, which allowed us to formulate a criterion for describing all equilibrium states in which partial clearing of markets occurs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEconomic Complexity Alignment and Sustainable Development

César A. Hidalgo, Quinten De Wettinck, Karolien De Bruyne et al.

Sustainable regional economic development and land use: a case of Russia

Wadim Strielkowski, Oxana Mukhoryanova, Oxana Kuznetsova et al.

An Approach on the Modelling of Long Economic Cycles in the Context of Sustainable Development

Camelia Oprean-Stan, Amelia Bucur, Cristina Tanasescu

No citations found for this paper.

Comments (0)