Summary

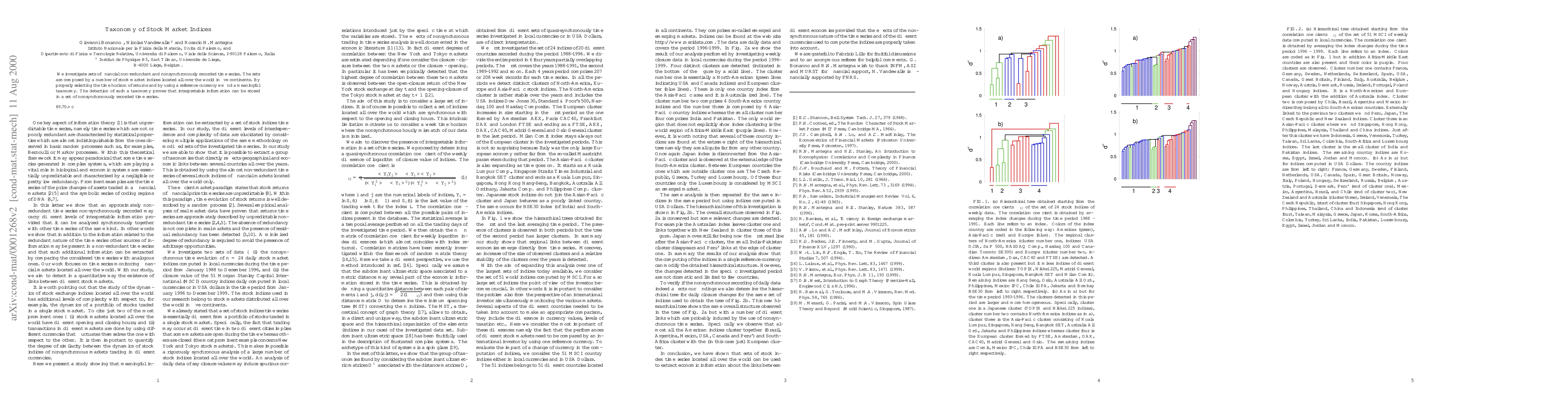

We investigate sets of financial non-redundant and nonsynchronously recorded time series. The sets are composed by a number of stock market indices located all over the world in five continents. By properly selecting the time horizon of returns and by using a reference currency we find a meaningful taxonomy. The detection of such a taxonomy proves that interpretable information can be stored in a set of nonsynchronously recorded time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)