Summary

As the US tax law evolves to adapt to ever-changing politico-economic realities, tax preparation software plays a significant role in helping taxpayers navigate these complexities. The dynamic nature of tax regulations poses a significant challenge to accurately and timely maintaining tax software artifacts. The state-of-the-art in maintaining tax prep software is time-consuming and error-prone as it involves manual code analysis combined with an expert interpretation of tax law amendments. We posit that the rigor and formality of tax amendment language, as expressed in IRS publications, makes it amenable to automatic translation to executable specifications (code). Our research efforts focus on identifying, understanding, and tackling technical challenges in leveraging Large Language Models (LLMs), such as ChatGPT and Llama, to faithfully extract code differentials from IRS publications and automatically integrate them with the prior version of the code to automate tax prep software maintenance.

AI Key Findings

Generated Jun 09, 2025

Methodology

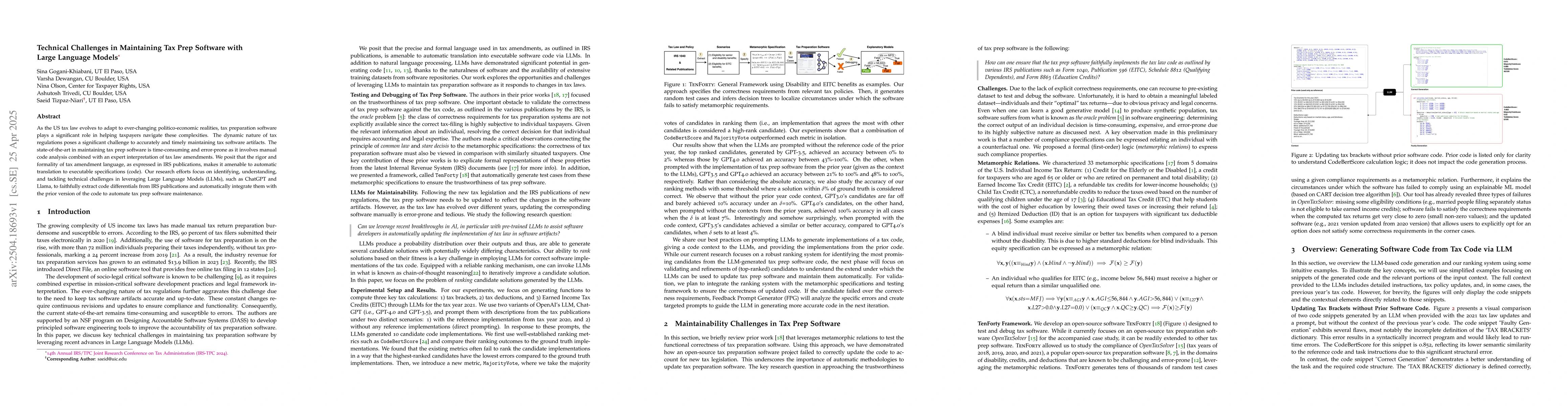

The research proposes an AI-assisted framework for automatically updating tax preparation software using Large Language Models (LLMs) like ChatGPT and Llama. The framework involves a cyclical process comprising input and analysis, code generation, ranking and selection, metamorphic testing, and a feedback loop for iterative refinement.

Key Results

- LLMs, especially GPT-4, demonstrate superior performance in generating tax preparation software code, particularly when provided with the previous year's code context.

- The ranking system effectively distinguishes between code candidates with varying levels of quality and correctness, enabling the selection of the most promising candidates for further validation and refinement.

- Metamorphic testing further validates the top-ranked code candidates, ensuring their correctness or identifying failed test cases for refinement.

- GPT-4 consistently outperforms GPT-3.5 in generating accurate tax calculation code, especially in more complex scenarios involving deductions and EITC.

- The study highlights the potential of LLMs in automating tax prep software maintenance, reducing manual effort, and increasing trustworthiness.

Significance

This research is significant as it addresses the challenge of maintaining tax preparation software amidst the dynamic nature of tax regulations. By leveraging LLMs, the proposed framework aims to automate the process, reduce human error, and ensure timely updates, which is crucial given the complexity and annual changes in US tax laws.

Technical Contribution

The paper presents a novel AI-assisted framework that leverages Large Language Models for automatically updating tax preparation software, addressing the technical challenges associated with adapting software to annual tax policy revisions.

Novelty

The research introduces a unique approach to software maintenance by employing LLMs for generating and refining tax software code, which is a novel application of AI in the domain of tax preparation software updates.

Limitations

- The study primarily focuses on the ranking system for LLM-generated code and does not fully integrate metamorphic testing as a validation component in the framework.

- The development of effective feedback prompt generators for guiding LLMs in generating candidate code requires extensive future work.

- The performance of LLMs, especially GPT-3.5, can be inconsistent, particularly in generating high-quality code from scratch without prior code context.

Future Work

- Integrate metamorphic testing more robustly as a validation component within the framework.

- Investigate and develop more sophisticated feedback prompt generators to guide LLMs in generating high-quality candidate code.

- Explore the application of the framework to other complex software maintenance tasks beyond tax preparation software.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn LLM Agentic Approach for Legal-Critical Software: A Case Study for Tax Prep Software

Ashutosh Trivedi, Saeid Tizpaz-Niari, Diptikalyan Saha et al.

The Current Challenges of Software Engineering in the Era of Large Language Models

Cuiyun Gao, Zhi Jin, Xin Xia et al.

Large Language Models for Software Engineering: Survey and Open Problems

Angela Fan, Shin Yoo, Jie M. Zhang et al.

Redefining Developer Assistance: Through Large Language Models in Software Ecosystem

Somnath Banerjee, Sayan Layek, Rima Hazra et al.

No citations found for this paper.

Comments (0)