Authors

Summary

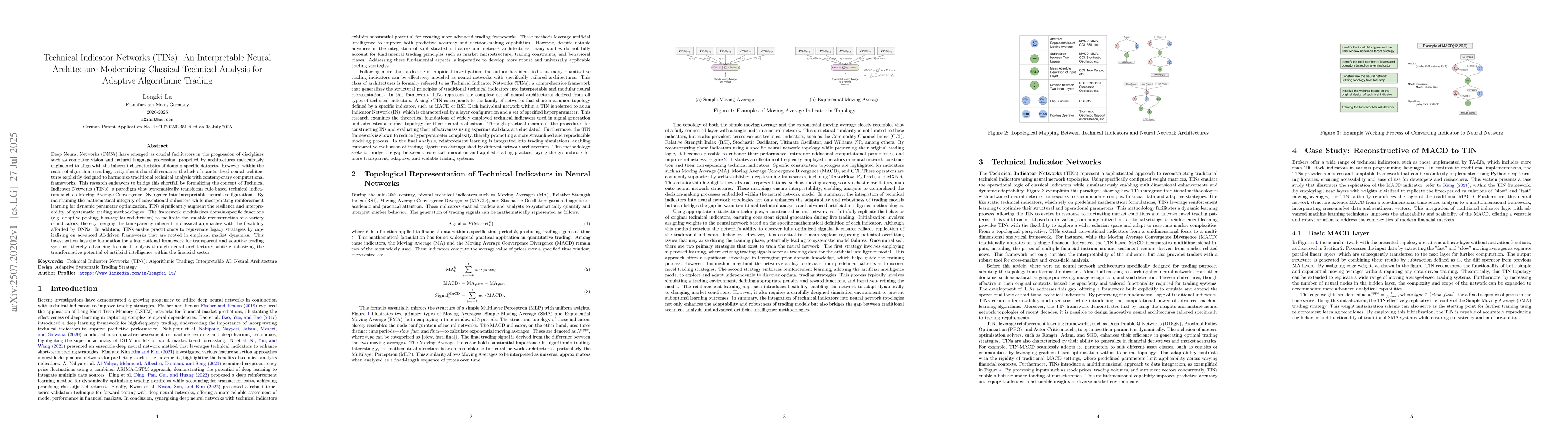

This work proposes that a vast majority of classical technical indicators in financial analysis are, in essence, special cases of neural networks with fixed and interpretable weights. It is shown that nearly all such indicators, such as moving averages, momentum-based oscillators, volatility bands, and other commonly used technical constructs, can be reconstructed topologically as modular neural network components. Technical Indicator Networks (TINs) are introduced as a general neural architecture that replicates and structurally upgrades traditional indicators by supporting n-dimensional inputs such as price, volume, sentiment, and order book data. By encoding domain-specific knowledge into neural structures, TINs modernize the foundational logic of technical analysis and propel algorithmic trading into a new era, bridging the legacy of proven indicators with the potential of contemporary AI systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Technical Indicator-based Trading Strategies Using NSGA-II

Vadlamani Ravi, P. Shanmukh Kali Prasad, Vadlamani Madhav et al.

No citations found for this paper.

Comments (0)