Authors

Summary

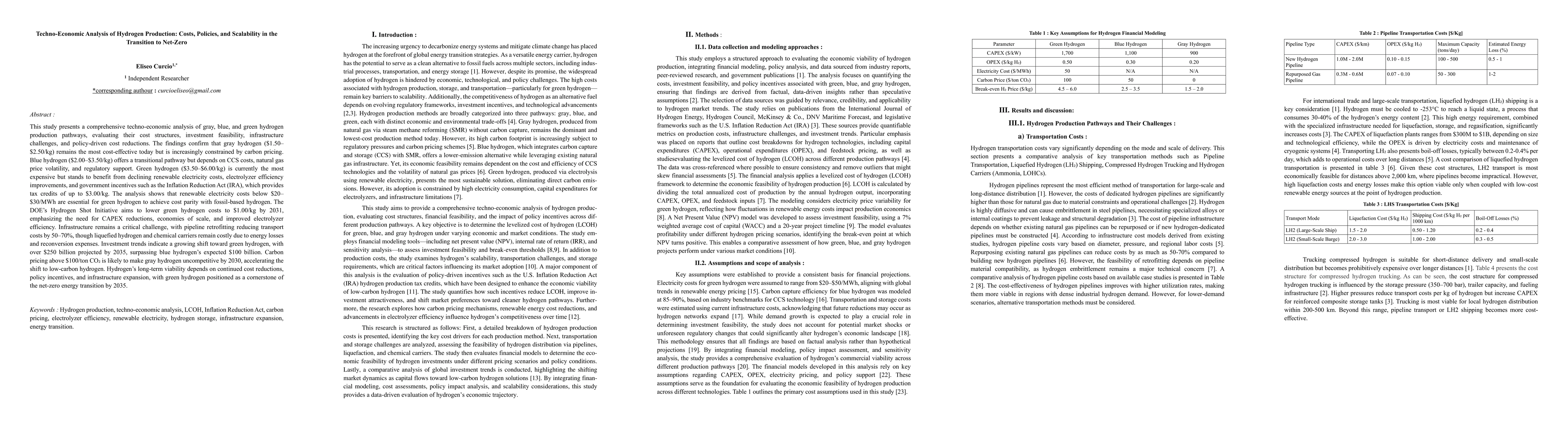

This study presents a comprehensive techno-economic analysis of gray, blue, and green hydrogen production pathways, evaluating their cost structures, investment feasibility, infrastructure challenges, and policy-driven cost reductions. The findings confirm that gray hydrogen (1.50-2.50/kg) remains the most cost-effective today but is increasingly constrained by carbon pricing. Blue hydrogen (2.00-3.50/kg) offers a transitional pathway but depends on CCS costs, natural gas price volatility, and regulatory support. Green hydrogen (3.50-6.00/kg) is currently the most expensive but benefits from declining renewable electricity costs, electrolyzer efficiency improvements, and government incentives such as the Inflation Reduction Act (IRA), which provides tax credits of up to 3.00/kg. The analysis shows that renewable electricity costs below 20-30/MWh are essential for green hydrogen to achieve cost parity with fossil-based hydrogen. The DOE's Hydrogen Shot Initiative aims to lower green hydrogen costs to 1.00/kg by 2031, emphasizing the need for CAPEX reductions, economies of scale, and improved electrolyzer efficiency. Infrastructure remains a critical challenge, with pipeline retrofitting reducing transport costs by 50-70%, though liquefied hydrogen and chemical carriers remain costly due to energy losses and reconversion expenses. Investment trends indicate a shift toward green hydrogen, with over 250 billion projected by 2035, surpassing blue hydrogen's expected 100 billion. Carbon pricing above $100/ton CO2 will likely make gray hydrogen uncompetitive by 2030, accelerating the shift to low-carbon hydrogen. Hydrogen's long-term viability depends on continued cost reductions, policy incentives, and infrastructure expansion, with green hydrogen positioned as a cornerstone of the net-zero energy transition by 2035.

AI Key Findings

Generated Jun 11, 2025

Methodology

The study conducted a comprehensive techno-economic analysis of gray, blue, and green hydrogen production pathways, evaluating cost structures, investment feasibility, infrastructure challenges, and policy-driven cost reductions.

Key Results

- Gray hydrogen ($1.50–$2.50/kg) is currently the most cost-effective but faces constraints from carbon pricing and regulatory pressures.

- Blue hydrogen ($2.00–$3.50/kg) offers a transitional pathway dependent on natural gas prices, carbon capture efficiency, and policy incentives.

- Green hydrogen ($3.50–$6.00/kg) is expensive but improving due to declining renewable electricity costs, electrolyzer efficiency improvements, and policy mechanisms like the Inflation Reduction Act (IRA) tax credits.

- Electricity costs are the primary driver of green hydrogen competitiveness, with renewable electricity prices below $20–$30/MWh necessary for cost parity with fossil-based hydrogen.

- Infrastructure remains a major barrier, with pipeline transport being the most cost-effective long-term solution for hydrogen deployment.

Significance

This research provides crucial insights into the future of hydrogen production, highlighting the need for continued cost reductions, policy incentives, and infrastructure expansion to ensure hydrogen's role in the net-zero energy transition.

Technical Contribution

The study presents a detailed analysis of the levelized cost of hydrogen (LCOH) for different production pathways, emphasizing the importance of electricity costs and policy incentives in determining competitiveness.

Novelty

This research offers a comprehensive comparison of gray, blue, and green hydrogen production costs, incorporating the latest policy developments and technological advancements, providing a roadmap for stakeholders in the hydrogen sector.

Limitations

- The study did not account for potential technological breakthroughs that could further reduce costs or improve efficiency.

- Regional variations in renewable energy availability and costs were not explicitly considered in the analysis.

Future Work

- Further research should explore the impact of emerging electrolyzer technologies on cost reductions and efficiency improvements.

- Investigating region-specific hydrogen production costs and their implications for global decarbonization strategies would be beneficial.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Role of Net-Zero Energy Residential Buildings in Florida's Energy Transition: Economic Analysis and Technical Benefits

Hamed Haggi, James M. Fenton

Techno-Economic Assessment of Net-Zero Energy Buildings: Financial Projections and Incentives for Achieving Energy Decarbonization Goals

Hamed Haggi, James M. Fenton

Techno-Economic Analysis of Synthetic Fuel Production from Existing Nuclear Power Plants across the United States

Qian Zhang, Michael T. Craig, Marisol Garrouste et al.

No citations found for this paper.

Comments (0)