Summary

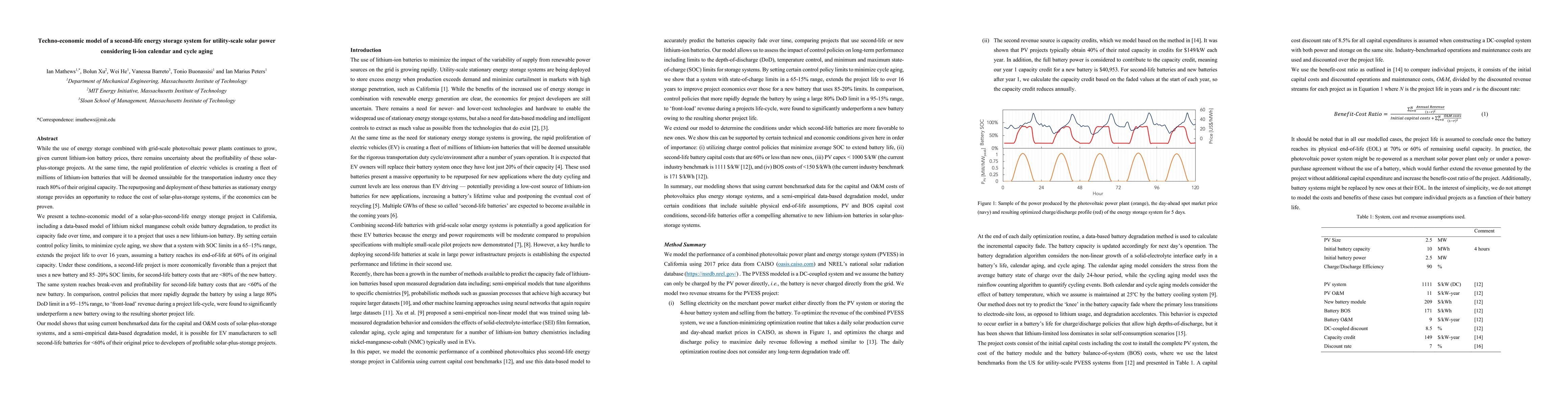

While the use of energy storage combined with grid-scale photovoltaic power plants continues to grow, given current lithium-ion battery prices, there remains uncertainty about the profitability of these solar-plus-storage projects. At the same time, the rapid proliferation of electric vehicles is creating a fleet of millions of lithium-ion batteries that will be deemed unsuitable for the transportation industry once they reach 80 percent of their original capacity. The repurposing and deployment of these batteries as stationary energy storage provides an opportunity to reduce the cost of solar-plus-storage systems, if the economics can be proven. We present a techno-economic model of a solar-plus-second-life energy storage project in California, including a data-based model of lithium nickel manganese cobalt oxide battery degradation, to predict its capacity fade over time, and compare it to a project that uses a new lithium-ion battery. By setting certain control policy limits, to minimize cycle aging, we show that a system with SOC limits in a 65 to 15 percent range, extends the project life to over 16 years, assuming a battery reaches its end-of-life at 60 percent of its original capacity. Under these conditions, a second-life project is more economically favorable than a project that uses a new battery and 85 to 20 percent SOC limits, for second-life battery costs that are less than 80 percent of the new battery. The same system reaches break-even and profitability for second-life battery costs that are less than 60 percent of the new battery. Our model shows that using current benchmarked data for the capital and O&M costs of solar-plus-storage systems, and a semi-empirical data-based degradation model, it is possible for EV manufacturers to sell second-life batteries for less than 60 percent of their original price to developers of profitable solar-plus-storage projects.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEconomic Optimal Power Management of Second-Life Battery Energy Storage Systems

Di Wu, Yebin Wang, Huazhen Fang et al.

Utility-Scale Bifacial Solar Photovoltaic System: Optimum Sizing and Techno-Economic Evaluation

Feng Lin, Caisheng Wang, Sharaf K. Magableh

A Review of Lithium-Ion Battery Models in Techno-economic Analyses of Power Systems

Hamidreza Zareipour, Anton V. Vykhodtsev, Darren Jang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)