Summary

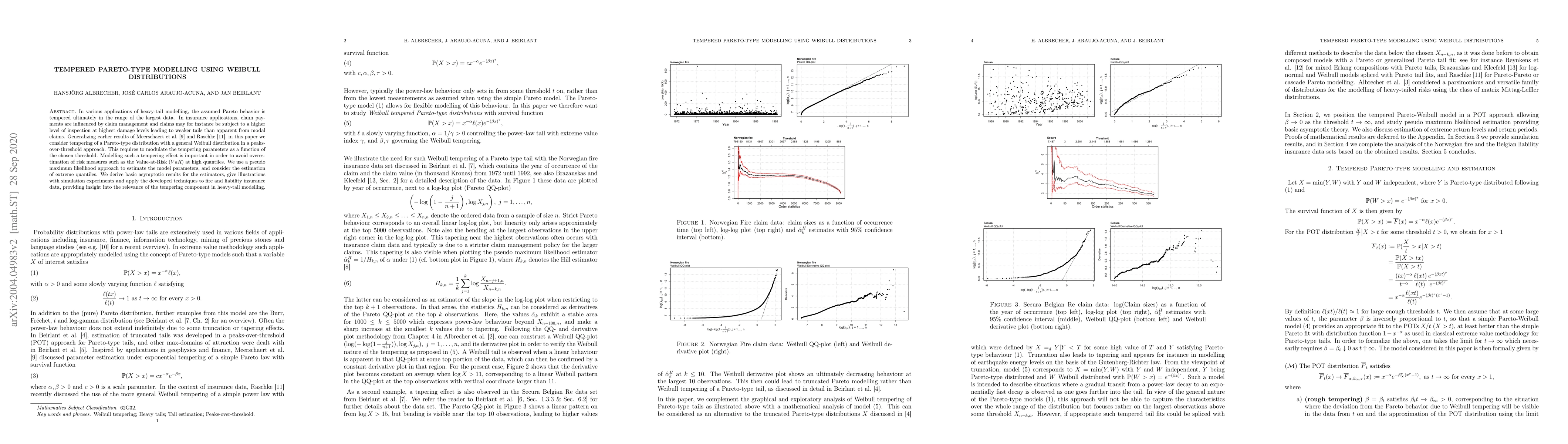

In various applications of heavy-tail modelling, the assumed Pareto behavior is tempered ultimately in the range of the largest data. In insurance applications, claim payments are influenced by claim management and claims may for instance be subject to a higher level of inspection at highest damage levels leading to weaker tails than apparent from modal claims. Generalizing earlier results of Meerschaert et al. (2012) and Raschke (2019), in this paper we consider tempering of a Pareto-type distribution with a general Weibull distribution in a peaks-over-threshold approach. This requires to modulate the tempering parameters as a function of the chosen threshold. Modelling such a tempering effect is important in order to avoid overestimation of risk measures such as the Value-at-Risk (VaR) at high quantiles. We use a pseudo maximum likelihood approach to estimate the model parameters, and consider the estimation of extreme quantiles. We derive basic asymptotic results for the estimators, give illustrations with simulation experiments and apply the developed techniques to fire and liability insurance data, providing insight into the relevance of the tempering component in heavy-tail modelling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom Pareto to Weibull -- a constructive review of distributions on $\mathbb{R}^+$

Christophe Ley, Patrick Weber, Corinne Sinner et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)