Summary

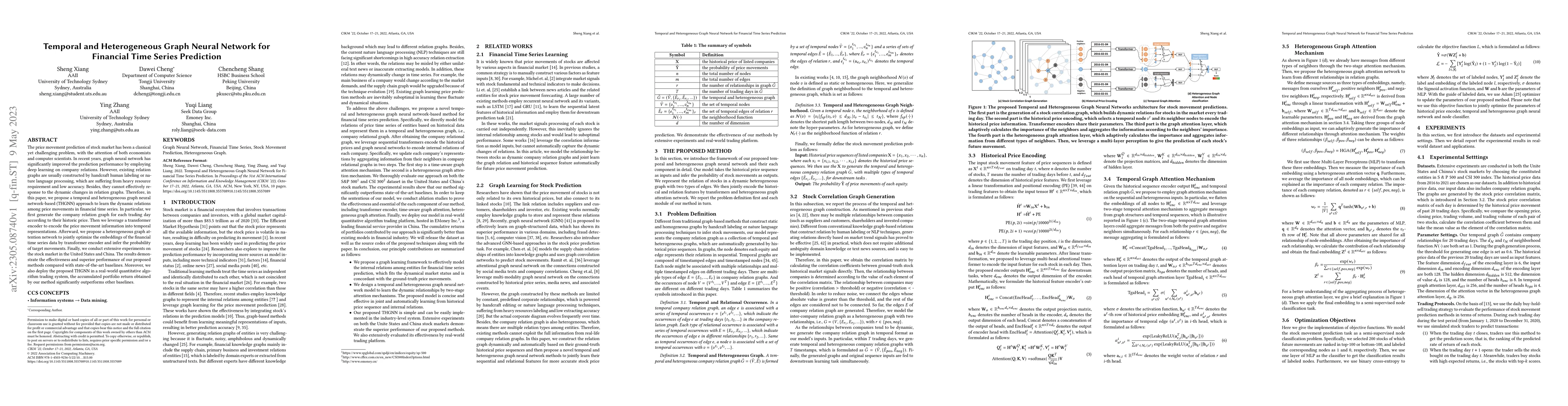

The price movement prediction of stock market has been a classical yet challenging problem, with the attention of both economists and computer scientists. In recent years, graph neural network has significantly improved the prediction performance by employing deep learning on company relations. However, existing relation graphs are usually constructed by handcraft human labeling or nature language processing, which are suffering from heavy resource requirement and low accuracy. Besides, they cannot effectively response to the dynamic changes in relation graphs. Therefore, in this paper, we propose a temporal and heterogeneous graph neural network-based (THGNN) approach to learn the dynamic relations among price movements in financial time series. In particular, we first generate the company relation graph for each trading day according to their historic price. Then we leverage a transformer encoder to encode the price movement information into temporal representations. Afterward, we propose a heterogeneous graph attention network to jointly optimize the embeddings of the financial time series data by transformer encoder and infer the probability of target movements. Finally, we conduct extensive experiments on the stock market in the United States and China. The results demonstrate the effectiveness and superior performance of our proposed methods compared with state-of-the-art baselines. Moreover, we also deploy the proposed THGNN in a real-world quantitative algorithm trading system, the accumulated portfolio return obtained by our method significantly outperforms other baselines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-head Temporal Attention-Augmented Bilinear Network for Financial time series prediction

Martin Magris, Mostafa Shabani, Alexandros Iosifidis et al.

Temporal and Heterogeneous Graph Neural Network for Remaining Useful Life Prediction

Fayao Liu, Min Wu, Zhenghua Chen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)