Summary

We propose Temporal Conformal Prediction (TCP), a novel framework for constructing prediction intervals in financial time-series with guaranteed finite-sample validity. TCP integrates quantile regression with a conformal calibration layer that adapts online via a decaying learning rate. This hybrid design bridges statistical and machine learning paradigms, enabling TCP to accommodate non-stationarity, volatility clustering, and regime shifts which are hallmarks of real-world asset returns, without relying on rigid parametric assumptions. We benchmark TCP against established methods including GARCH, Historical Simulation, and static Quantile Regression across equities (S&P 500), cryptocurrency (Bitcoin), and commodities (Gold). Empirical results show that TCP consistently delivers sharper intervals with competitive or superior coverage, particularly in high-volatility regimes. Our study underscores TCP's strength in navigating the coverage-sharpness tradeoff, a central challenge in modern risk forecasting. Overall, TCP offers a distribution-free, adaptive, and interpretable alternative for financial uncertainty quantification, advancing the interface between statistical inference and machine learning in finance.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research methodology involves an empirical study evaluating the performance of Temporal Conformal Prediction (TCP) against established methods like Quantile Regression (QR), GARCH, and Historical Simulation across equities, cryptocurrency, and commodities. The study uses daily log-returns from November 2017 to May 2025, incorporating features such as lagged returns, rolling volatility, and nonlinear transformations.

Key Results

- TCP consistently delivers sharper intervals with competitive or superior coverage, particularly in high-volatility regimes.

- Static machine learning models like QR, while producing sharp intervals, are fundamentally unreliable for risk forecasting due to poor calibration.

- TCP demonstrates a clear and superior ability to adapt to changing market conditions, effectively navigating the coverage-sharpness tradeoff.

Significance

This research offers a distribution-free, adaptive, and interpretable alternative for financial uncertainty quantification, advancing the interface between statistical inference and machine learning in finance.

Technical Contribution

TCP combines the strengths of quantile regression with conformal calibration, adapting over time using a decaying learning rate to correct for miscalibration.

Novelty

Unlike existing adaptive conformal approaches, TCP explicitly leverages temporal exchangeability and a modified Robbins-Monro scheme to handle the unique non-stationarity of financial time series, making it particularly suited for regulatory applications requiring robustness to market regime shifts.

Limitations

- The study focuses on univariate daily returns, leaving scope for extensions to multivariate or portfolio-level forecasting.

- The sensitivity analysis is conducted on a limited set of hyperparameters, and further exploration could enhance the robustness claims.

Future Work

- Generalize TCP to multivariate or portfolio-level forecasting using deep copula models.

- Benchmark TCP against volatility models leveraging realized-volatility inputs.

- Apply TCP to detect financial bubbles and predict subsequent implosions.

- Adapt TCP from general risk monitoring to event-specific forecasting, like predicting extreme monthly drawdowns.

Paper Details

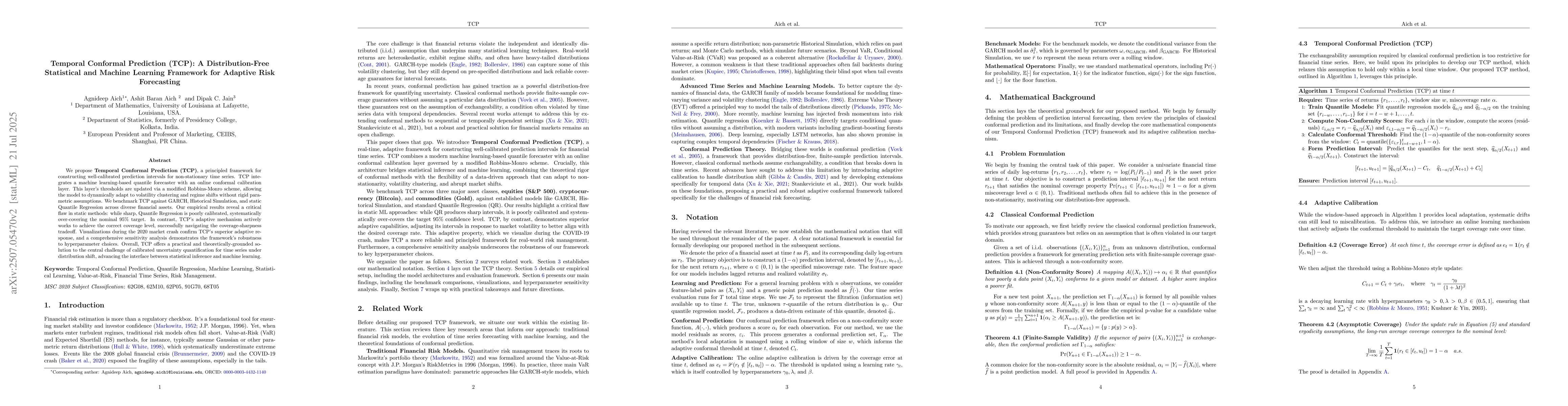

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCopula Conformal Prediction for Multi-step Time Series Forecasting

Rose Yu, Sophia Sun

ResCP: Reservoir Conformal Prediction for Time Series Forecasting

Filippo Maria Bianchi, Michael M. Bronstein, Andrea Cini et al.

A Gentle Introduction to Conformal Prediction and Distribution-Free Uncertainty Quantification

Anastasios N. Angelopoulos, Stephen Bates

DRAN: A Distribution and Relation Adaptive Network for Spatio-temporal Forecasting

Yang Tang, Cesare Alippi, Xiaobei Zou et al.

No citations found for this paper.

Comments (0)