Summary

In this paper, we study term structure movements in the spirit of Heath, Jarrow, and Morton [Econometrica 60(1), 77-105] under volatility uncertainty. We model the instantaneous forward rate as a diffusion process driven by a G-Brownian motion. The G-Brownian motion represents the uncertainty about the volatility. Within this framework, we derive a sufficient condition for the absence of arbitrage, known as the drift condition. In contrast to the traditional model, the drift condition consists of several equations and several market prices, termed market price of risk and market prices of uncertainty, respectively. The drift condition is still consistent with the classical one if there is no volatility uncertainty. Similar to the traditional model, the risk-neutral dynamics of the forward rate are completely determined by its diffusion term. The drift condition allows to construct arbitrage-free term structure models that are completely robust with respect to the volatility. In particular, we obtain robust versions of classical term structure models.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper studies term structure modeling under volatility uncertainty, using a G-Brownian motion to model the instantaneous forward rate as a diffusion process, incorporating uncertainty about volatility.

Key Results

- A drift condition for the absence of arbitrage is derived, which includes market prices of risk and uncertainty.

- The risk-neutral dynamics of the forward rate are determined by its diffusion term, allowing for robust arbitrage-free term structure models.

- Robust versions of classical term structure models, such as Ho-Lee, Hull-White, and Vasicek, are obtained by specifying the diffusion term of the forward rate.

Significance

This research is significant as it extends traditional term structure models to account for volatility uncertainty, providing a more realistic framework for pricing interest rate derivatives in uncertain markets.

Technical Contribution

The paper introduces a drift condition for arbitrage-free term structure models under volatility uncertainty, extending the classical Heath-Jarrow-Morton (HJM) framework.

Novelty

The novelty lies in the incorporation of G-Brownian motion to model volatility uncertainty and the derivation of a drift condition that ensures arbitrage-free models, robust to volatility uncertainty.

Limitations

- The model assumes a one-dimensional G-Brownian motion and requires the initial forward curve to be differentiable.

- The drift condition introduces additional market prices of uncertainty, which may not always be observable or easily estimated.

Future Work

- Exploration of multi-dimensional G-Brownian motions to capture more complex volatility structures.

- Investigation of estimation methods for the additional market prices of uncertainty in practical applications.

Paper Details

PDF Preview

Key Terms

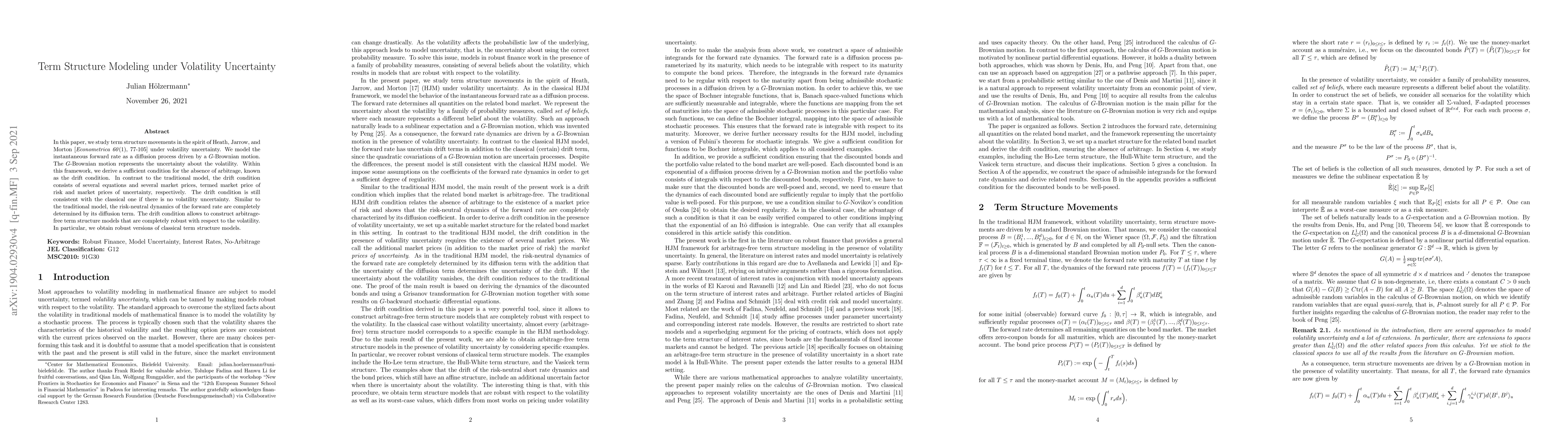

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantifying neural network uncertainty under volatility clustering

Steven Y. K. Wong, Jennifer S. K. Chan, Lamiae Azizi

Generalized Feynman-Kac Formula under volatility uncertainty

Francesca Biagini, Andrea Mazzon, Katharina Oberpriller et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)