Authors

Summary

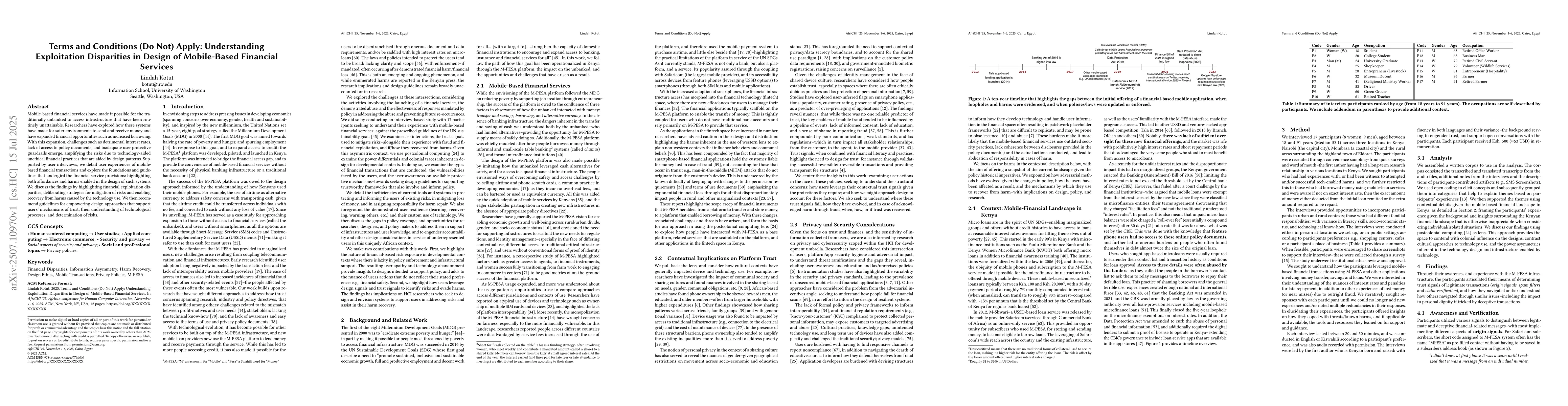

Mobile-based financial services have made it possible for the traditionally unbanked to access infrastructure that have been routinely unattainable. Researchers have explored how these systems have made for safer environments to send and receive money and have expanded financial opportunities such as increased borrowing. With this expansion, challenges such as detrimental interest rates, lack of access to policy documents, and inadequate user protective guardrails emerge, amplifying the risks due to technology-aided unethical financial practices that are aided by design patterns. Supported by user interviews, we detail user experiences of mobile-based financial transactions and explore the foundations and guidelines that undergird the financial service provisions: highlighting both affordances and harms enabled in the design of such systems. We discuss the findings by highlighting financial exploitation disparities, deliberating strategies for mitigation of risks and enabling recovery from harms caused by the technology use. We then recommend guidelines for empowering design approaches that support users' mechanisms of trust, their understanding of technological processes, and determination of risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)