Summary

Given a positive random variable $X$, $X\ge0$ a.s., a null hypothesis $H_0:E(X)\le\mu$ and a random sample of infinite size of $X$, we construct test supermartingales for $H_0$, i.e. positive processes that are supermartingale if the null hypothesis is satisfied. We test hypothesis $H_0$ by testing the supermartingale hypothesis on a test supermartingale. We construct test supermartingales that lead to tests with power 1. We derive confidence lower bounds. For bounded random variables we extend the techniques to two-sided tests of $H_0:E(X)=\mu$ and to the construction of confidence intervals. In financial auditing random sampling is proposed as one of the possible techniques to gather enough evidence to justify rejection of the null hypothesis that there is a 'material' misstatement in a financial report. The goal of our work is to provide a mathematical context that could represent such process of gathering evidence by means of repeated random sampling, while ensuring an intended significance level.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

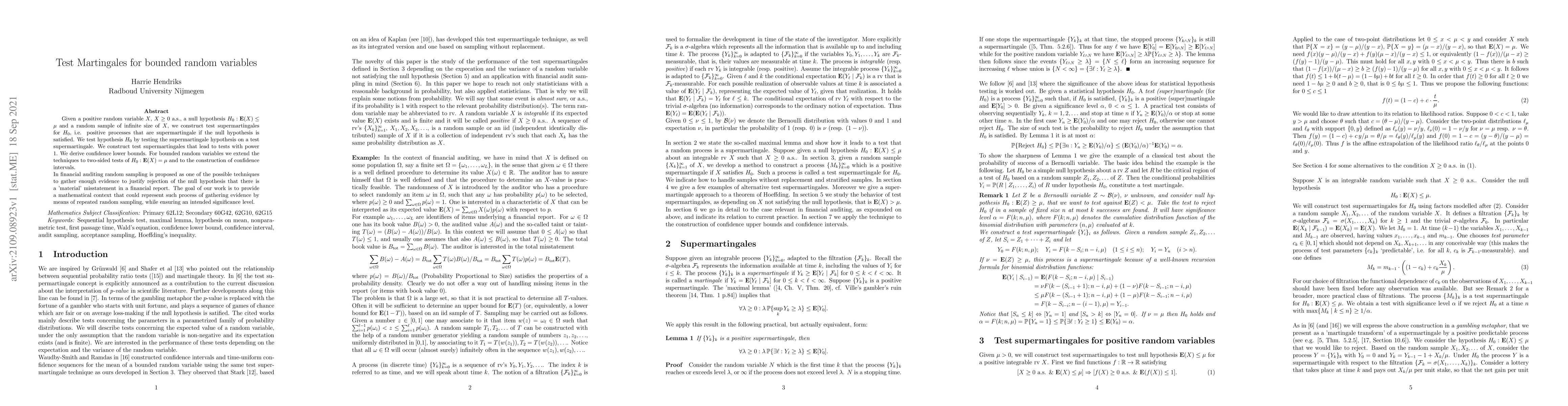

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)