Authors

Summary

Testing by betting has been a cornerstone of the game-theoretic statistics literature. In this framework, a betting score (or more generally an e-process), as opposed to a traditional p-value, is used to quantify the evidence against a null hypothesis: the higher the betting score, the more money one has made betting against the null, and thus the larger the evidence that the null is false. A key ingredient assumed throughout past works is that one cannot bet more money than one currently has. In this paper, we ask what happens if the bettor is allowed to borrow money after going bankrupt, allowing further financial flexibility in this game of hypothesis testing. We propose various definitions of (adjusted) evidence relative to the wealth borrowed, indebted, and accumulated. We also ask what happens if the bettor can "bargain", in order to obtain odds bettor than specified by the null hypothesis. The adjustment of wealth in order to serve as evidence appeals to the characterization of arbitrage, interest rates, and num\'eraire-adjusted pricing in this setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

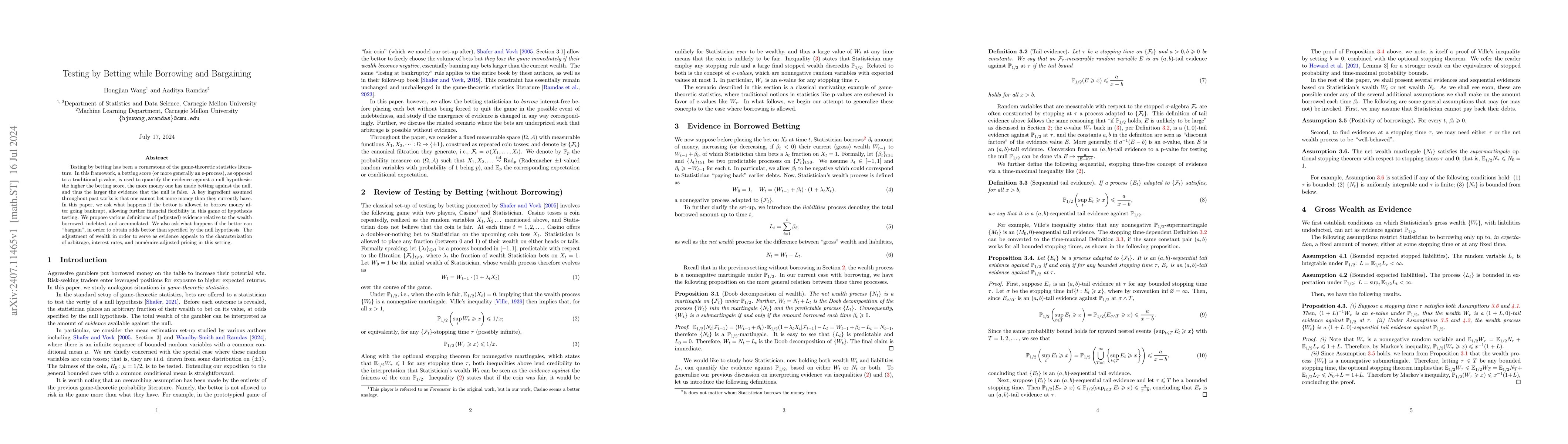

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)