Authors

Summary

This article discusses tests for nonlinear cointegration in the presence of variance breaks. We build on cointegration test approaches under heteroskedasticity (Cavaliere and Taylor, 2006, Journal of Time Series Analysis) and nonlinearity (Choi and Saikkonen, 2010, Econometric Theory) to propose a bootstrap test and prove its consistency. A Monte Carlo study shows the approach to have satisfactory finite-sample properties. We provide an empirical application to the environmental Kuznets curves (EKC), finding that the cointegration test provides little evidence for the EKC hypothesis. Additionally, we examine a nonlinear relation between the US money demand and the interest rate, finding that our test does not reject the null of a smooth transition cointegrating relation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

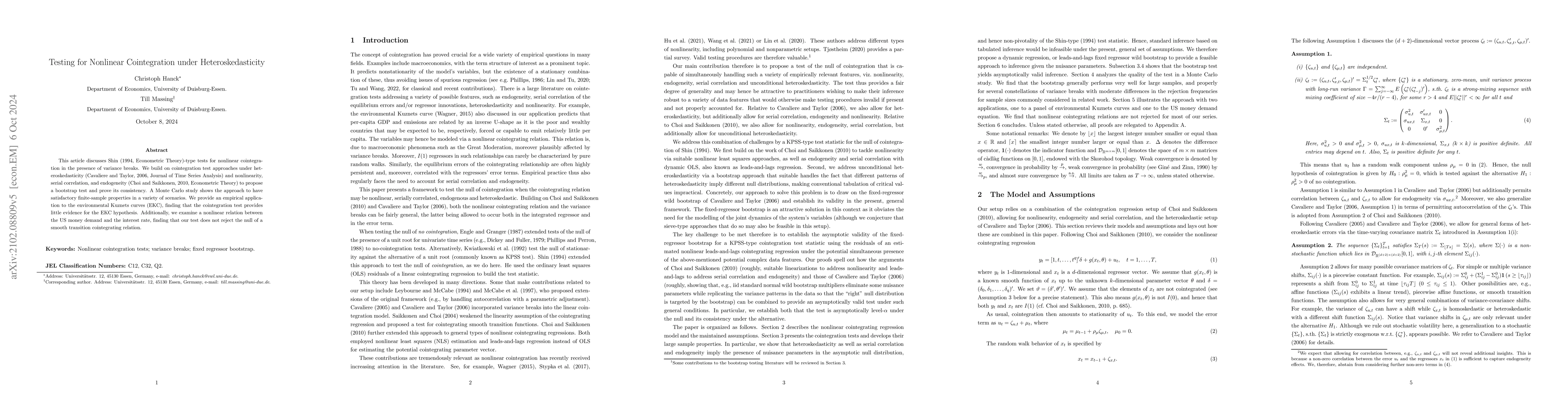

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTesting Many Restrictions Under Heteroskedasticity

Mikkel Sølvsten, Stanislav Anatolyev

Large-Scale Multiple Testing of Composite Null Hypotheses Under Heteroskedasticity

Bowen Gang, Trambak Banerjee

Valid Heteroskedasticity Robust Testing

Benedikt M. Pötscher, David Preinerstorfer

No citations found for this paper.

Comments (0)