Summary

Using one of the key property of copulas that they remain invariant under an arbitrary monotonous change of variable, we investigate the null hypothesis that the dependence between financial assets can be modeled by the Gaussian copula. We find that most pairs of currencies and pairs of major stocks are compatible with the Gaussian copula hypothesis, while this hypothesis can be rejected for the dependence between pairs of commodities (metals). Notwithstanding the apparent qualification of the Gaussian copula hypothesis for most of the currencies and the stocks, a non-Gaussian copula, such as the Student's copula, cannot be rejected if it has sufficiently many ``degrees of freedom''. As a consequence, it may be very dangerous to embrace blindly the Gaussian copula hypothesis, especially when the correlation coefficient between the pair of asset is too high as the tail dependence neglected by the Gaussian copula can be as large as 0.6, i.e., three out five extreme events which occur in unison are missed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

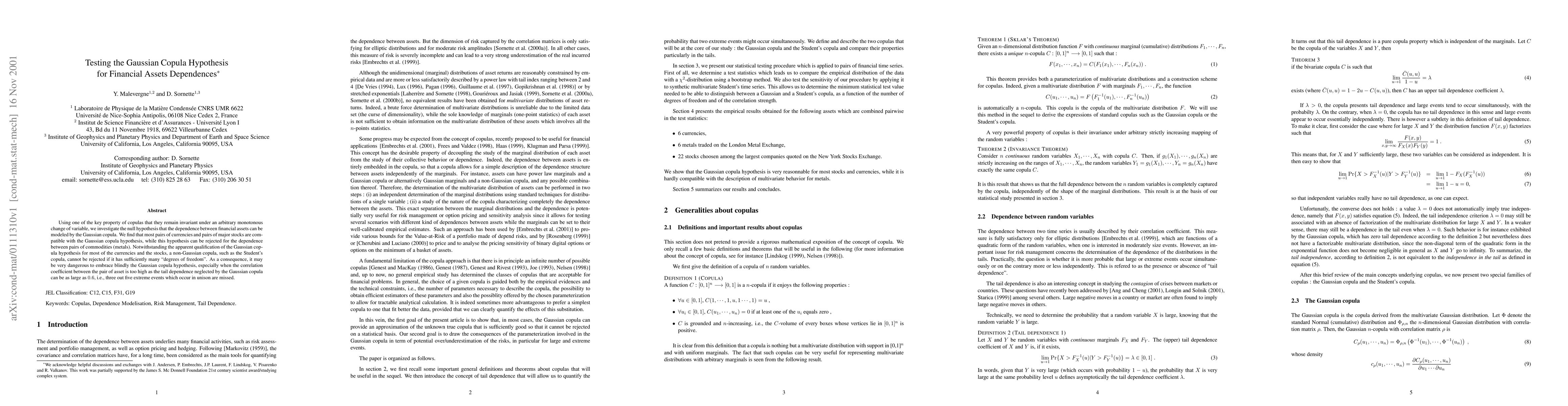

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCopula-based deviation measure of cointegrated financial assets

Alexander Shulzhenko

Copula estimation for nonsynchronous financial data

Rituparna Sen, Arnab Chakrabarti

| Title | Authors | Year | Actions |

|---|

Comments (0)