Summary

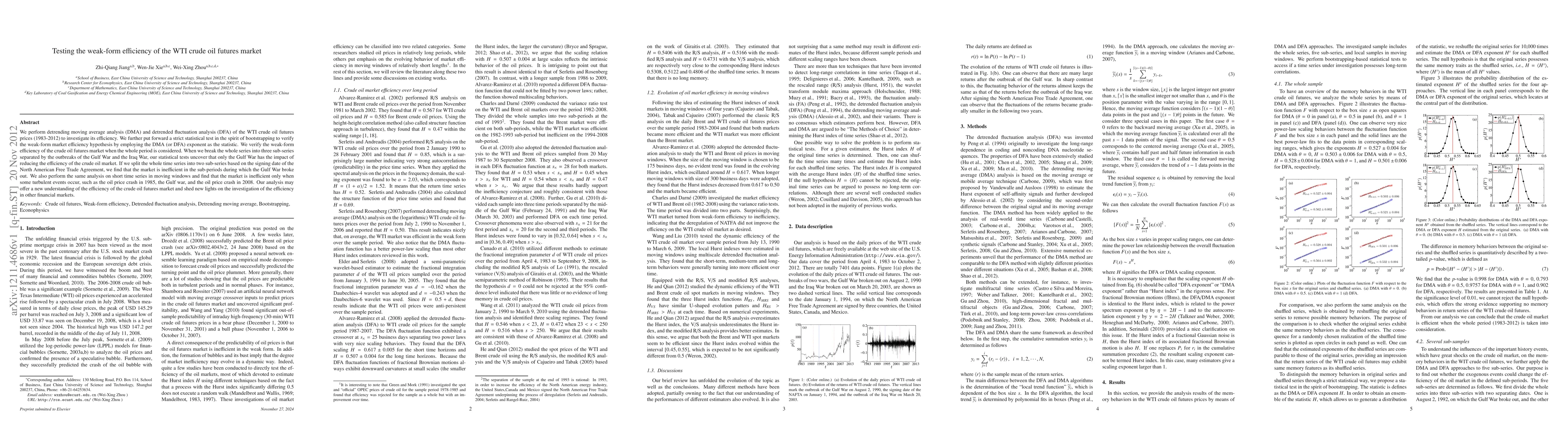

We perform detrending moving average analysis (DMA) and detrended fluctuation analysis (DFA) of the WTI crude oil futures prices (1983-2012) to investigate its efficiency. We further put forward a strict statistical test in the spirit of bootstrapping to verify the weak-form market efficiency hypothesis by employing the DMA (or DFA) exponent as the statistic. We verify the weak-form efficiency of the crude oil futures market when the whole period is considered. When we break the whole series into three sub-series separated by the outbreaks of the Gulf War and the Iraq War, our statistical tests uncover that only the Gulf War has the impact of reducing the efficiency of the crude oil market. If we split the whole time series into two sub-series based on the signing date of the North American Free Trade Agreement, we find that the market is inefficient in the sub-periods during which the Gulf War broke out. We also perform the same analysis on short time series in moving windows and find that the market is inefficient only when some turbulent events occur, such as the oil price crash in 1985, the Gulf war, and the oil price crash in 2008. Our analysis may offer a new understanding of the efficiency of the crude oil futures market and shed new lights on the investigation of the efficiency in other financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe short-term effect of COVID-19 pandemic on China's crude oil futures market: A study based on multifractal analysis

Shao Ying-Hui, Liu Ying-Lin, Yang Yan-Hong

A hidden Markov model for statistical arbitrage in international crude oil futures markets

Claudio Fontana, Viviana Fanelli, Francesco Rotondi

| Title | Authors | Year | Actions |

|---|

Comments (0)