Summary

Interest rate market models, like the LIBOR market model, have the advantage that the basic model quantities are directly observable in financial markets. Inflation market models extend this approach to inflation markets, where zero-coupon and year-on-year inflation-indexed swaps are the basic observable products. For inflation market models considered so far closed formulas exist for only one type of swap, but not for both. The model in this paper uses affine processes in such a way that prices for both types of swaps can be calculated explicitly. Furthermore call and put options on both types of swap rates can be calculated using one-dimensional Fourier inversion formulas. Using the derived formulas we present an example calibration to market data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

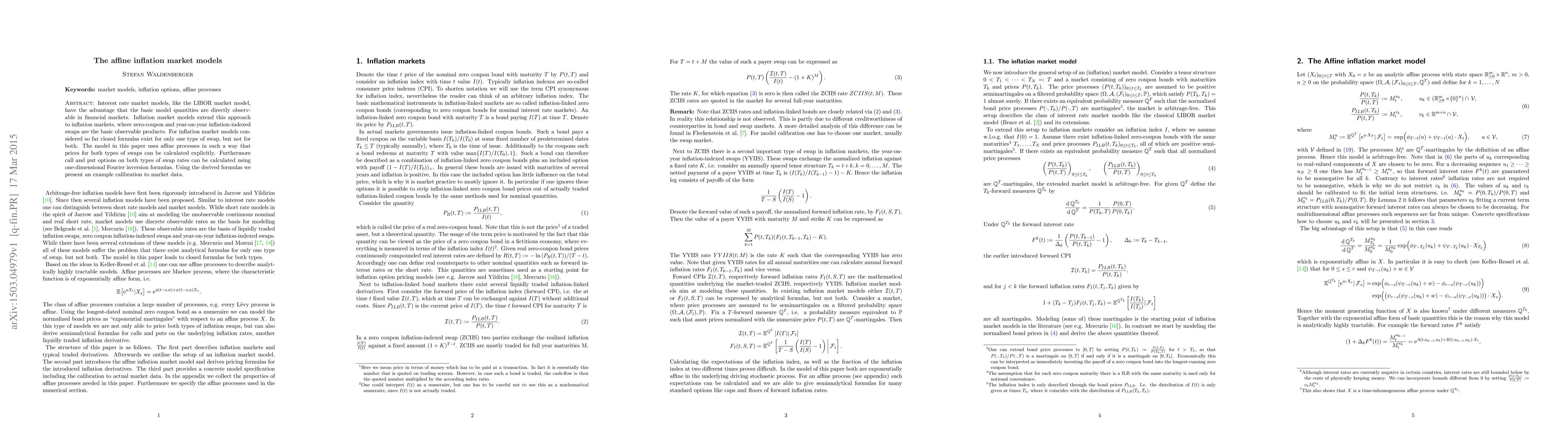

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)