Summary

We consider a stochastic volatility model which captures relevant stylized facts of financial series, including the multi-scaling of moments. The volatility evolves according to a generalized Ornstein-Uhlenbeck processes with super-linear mean reversion. Using large deviations techniques, we determine the asymptotic shape of the implied volatility surface in any regime of small maturity $t \to 0$ or extreme log-strike $|\kappa| \to \infty$ (with bounded maturity). Even if the price has continuous paths, out-of-the-money implied volatility diverges for small maturity, producing a very pronounced smile.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research employs large deviations techniques to analyze a stochastic volatility model with a generalized Ornstein-Uhlenbeck process for volatility, capturing multi-scaling moments of financial series.

Key Results

- The asymptotic shape of the implied volatility surface is determined for small maturity $t \\to 0$ or extreme log-strike $|\kappa| \\to \\infty$ with bounded maturity.

- Out-of-the-money implied volatility diverges for small maturity, producing a pronounced smile even with continuous price paths.

- The asymptotic behavior of the option price $c(\\kappa, t)$ is derived in various regimes of small $t$ and extreme $\\kappa$.

Significance

This study is significant as it provides a detailed analysis of implied volatility smile asymptotics in a multiscaling stochastic volatility model, which is crucial for accurate pricing and risk management in financial markets.

Technical Contribution

The paper presents a rigorous mathematical framework using large deviations theory to characterize the implied volatility surface and option pricing in a multiscaling stochastic volatility model.

Novelty

The work introduces a novel approach to model the multi-scaling of moments in financial series within a stochastic volatility framework, offering insights into the asymptotic behavior of the implied volatility surface and option prices.

Limitations

- The model assumes specific forms for the volatility dynamics and moment scaling, which might not capture all real-world complexities.

- The analysis focuses on asymptotic behavior, potentially overlooking transient effects that could be relevant in practical applications.

Future Work

- Investigate the model's performance with empirical financial data to validate its practical applicability.

- Explore extensions of the model to incorporate more complex features observed in financial markets, such as stochastic interest rates or jumps.

Paper Details

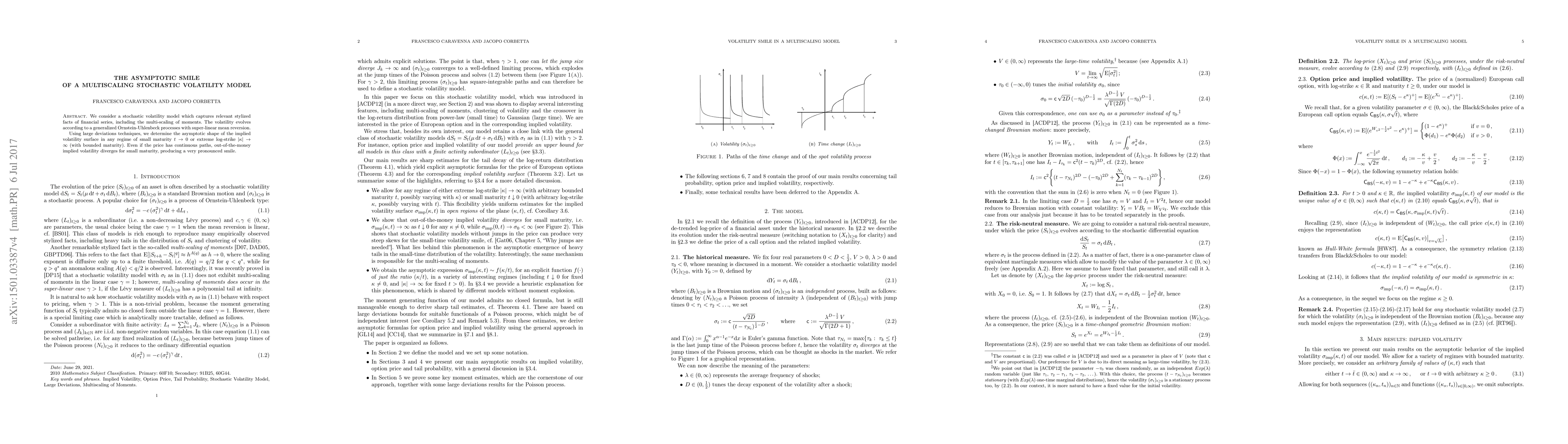

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

| Title | Authors | Year | Actions |

|---|

Comments (0)