Authors

Summary

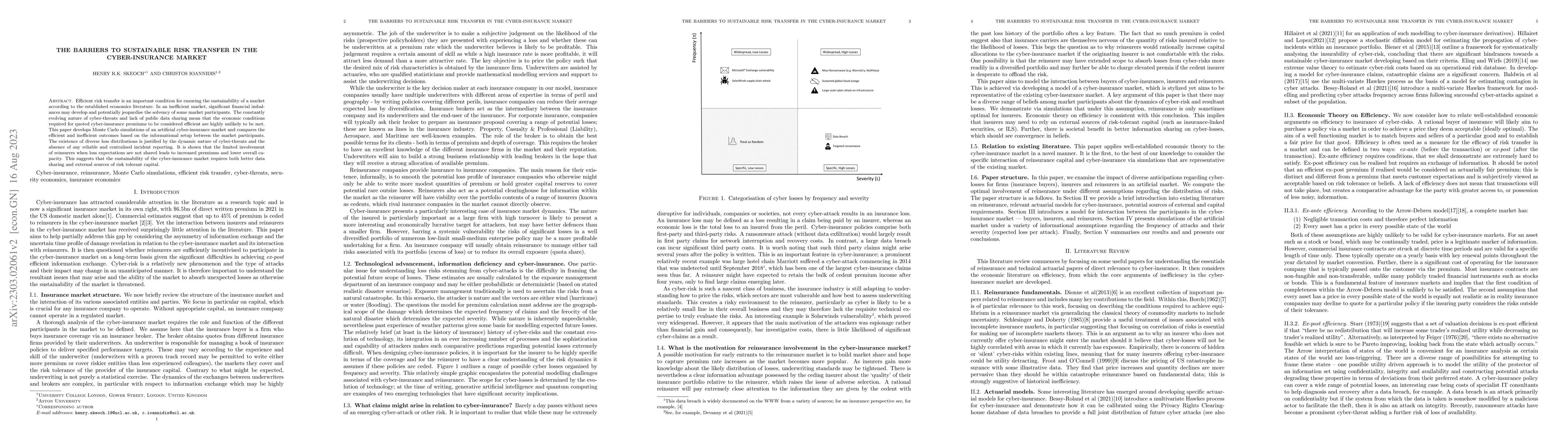

Efficient risk transfer is an important condition for ensuring the sustainability of a market according to the established economics literature. In an inefficient market, significant financial imbalances may develop and potentially jeopardise the solvency of some market participants. The constantly evolving nature of cyber-threats and lack of public data sharing mean that the economic conditions required for quoted cyber-insurance premiums to be considered efficient are highly unlikely to be met. This paper develops Monte Carlo simulations of an artificial cyber-insurance market and compares the efficient and inefficient outcomes based on the informational setup between the market participants. The existence of diverse loss distributions is justified by the dynamic nature of cyber-threats and the absence of any reliable and centralised incident reporting. It is shown that the limited involvement of reinsurers when loss expectations are not shared leads to increased premiums and lower overall capacity. This suggests that the sustainability of the cyber-insurance market requires both better data sharing and external sources of risk tolerant capital.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Bonus-Malus Framework for Cyber Risk Insurance and Optimal Cybersecurity Provisioning

Anwitaman Datta, Ariel Neufeld, Gareth W. Peters et al.

Cyber Risk Frequency, Severity and Insurance Viability

Georgy Sofronov, Gareth W. Peters, Matteo Malavasi et al.

On the Role of Risk Perceptions in Cyber Insurance Contracts

Quanyan Zhu, Shutian Liu

Incident-Specific Cyber Insurance

Linfeng Zhang, Zhiyu Quan, Wing Fung Chong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)