Summary

Studies report that firms do not invest in cost-effective green technologies. While economic barriers can explain parts of the gap, behavioural aspects cause further under-valuation. This could be partly due to systematic deviations of decision-making agents' perceptions from normative benchmarks, and partly due to their diversity. This paper combines available behavioural knowledge into a simple model of technology adoption. Firms are modelled as heterogeneous agents with different behavioural responses. To quantify the gap, the model simulates their investment decisions from different theoretical perspectives. While relevant parameters are uncertain at the micro-level, using distributed agent perspectives provides a realistic representation of the macro adoption rate. The model is calibrated using audit data for proposed investments in energy efficient electric motors. The inclusion of behavioural factors reduces significantly expected adoption rates: from 81% using a normative optimisation perspective, down to 20% using a behavioural perspective. The effectiveness of various policies is tested.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

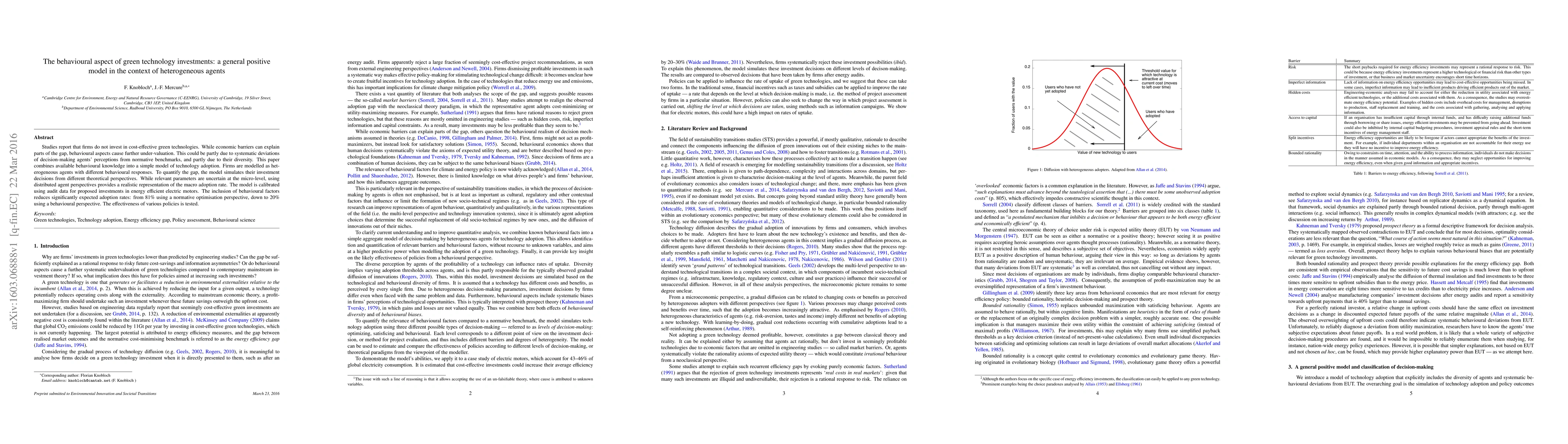

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBecoming Green: Decomposing the Macroeconomic Effects of Green Technology News Shocks

Andrey Ramos, Oscar Jaulin

| Title | Authors | Year | Actions |

|---|

Comments (0)