Summary

We generalise the so-called Bismut-Elworthy-Li formula to a class of stochastic differential equations whose coefficients might depend on the law of the solution. We give some examples of where this formula can be applied to in the context of finance and the computation of Greeks and provide with a simple but rather illustrative simulation experiment showing that the use of the Bismut-Elworthy-Li formula, also known as Malliavin method, is more efficient compared to the finite difference method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

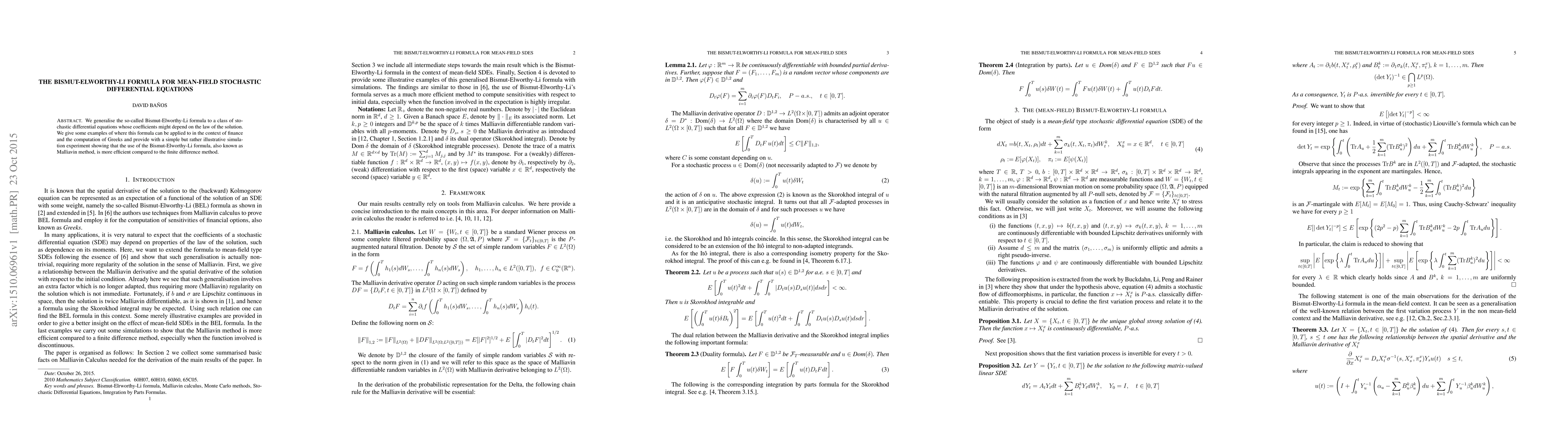

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Bismut-Elworthy-Li formula for semi-linear distribution-dependent SDEs driven by fractional Brownian motion

M. Tahmasebi

| Title | Authors | Year | Actions |

|---|

Comments (0)