Summary

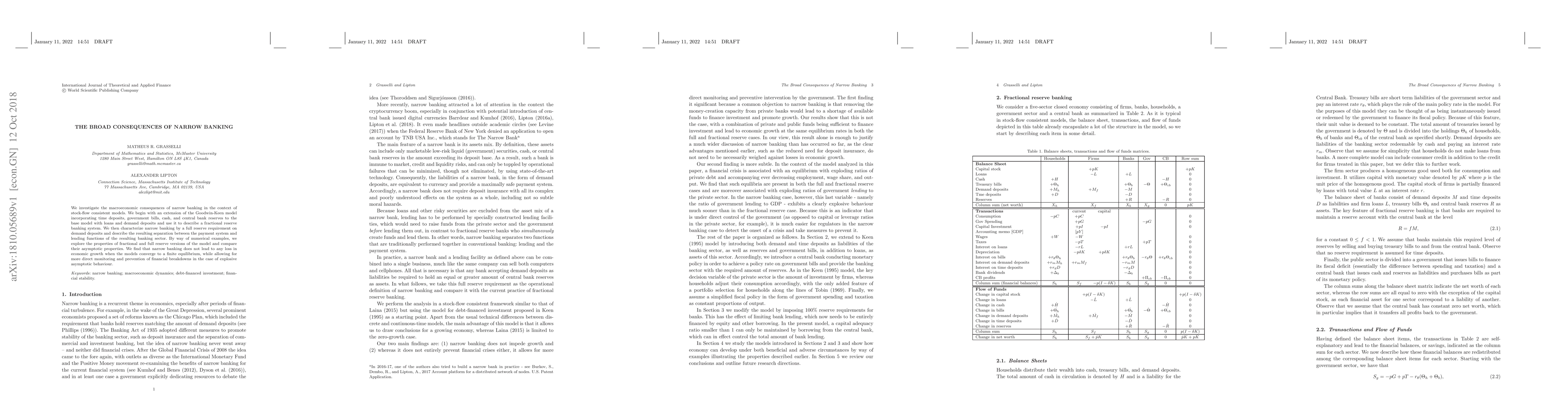

We investigate the macroeconomic consequences of narrow banking in the context of stock-flow consistent models. We begin with an extension of the Goodwin-Keen model incorporating time deposits, government bills, cash, and central bank reserves to the base model with loans and demand deposits and use it to describe a fractional reserve banking system. We then characterize narrow banking by a full reserve requirement on demand deposits and describe the resulting separation between the payment system and lending functions of the resulting banking sector. By way of numerical examples, we explore the properties of fractional and full reserve versions of the model and compare their asymptotic properties. We find that narrow banking does not lead to any loss in economic growth when the models converge to a finite equilibrium, while allowing for more direct monitoring and prevention of financial breakdowns in the case of explosive asymptotic behaviour.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)