Authors

Summary

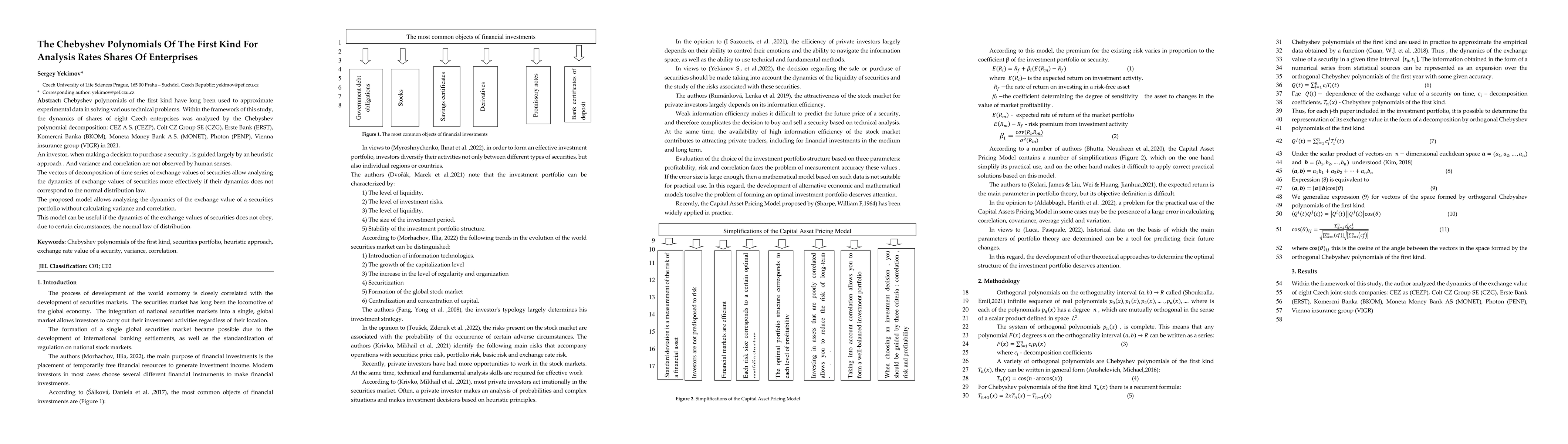

Chebyshev polynomials of the first kind have long been used to approximate experimental data in solving various technical problems. Within the framework of this study, the dynamics of shares of eight Czech enterprises was analyzed by the Chebyshev polynomial decomposition: CEZ A.S. (CEZP), Colt CZ Group SE (CZG), Erste Bank (ERST), Komercni Banka (BKOM), Moneta Money Bank A.S. (MONET), Photon (PENP), Vienna insurance group (VIGR) in 2021. An investor, when making a decision to purchase a security , is guided largely by an heuristic approach . And variance and correlation are not observed by human senses. The vectors of decomposition of time series of exchange values of securities allow analyzing the dynamics of exchange values of securities more effectively if their dynamics does not correspond to the normal distribution law. The proposed model allows analyzing the dynamics of the exchange value of a securities portfolio without calculating variance and correlation. This model can be useful if the dynamics of the exchange values of securities does not obey, due to certain circumstances, the normal law of distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)