Summary

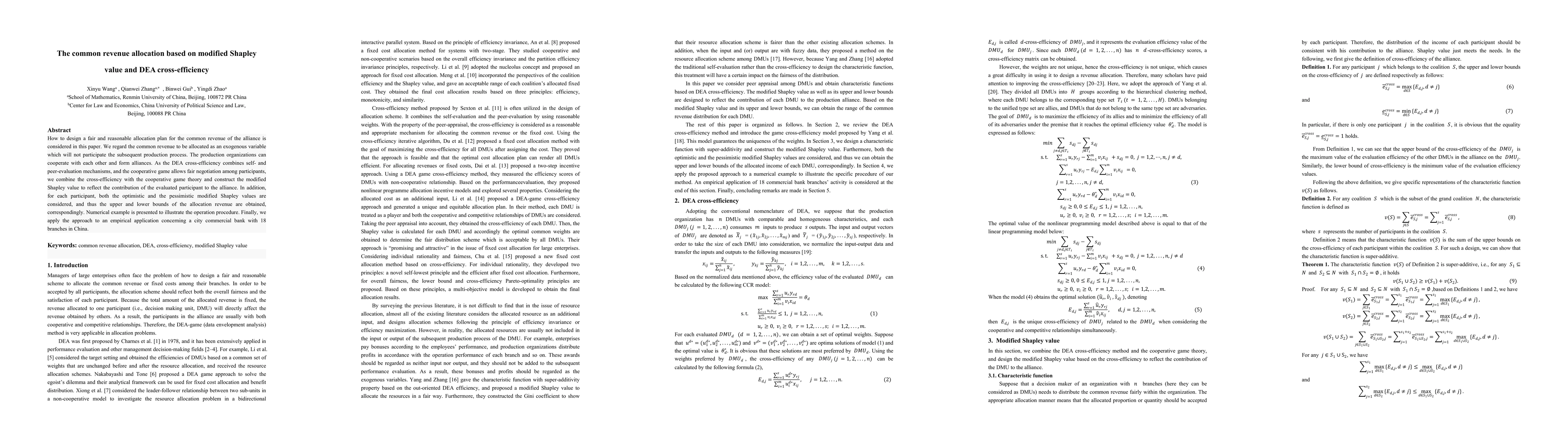

How to design a fair and reasonable allocation plan for the common revenue of the alliance is considered in this paper. We regard the common revenue to be allocated as an exogenous variable which will not participate in the subsequent production process. The production organizations can cooperate with each other and form alliances. As the DEA cross-efficiency combines self- and peer-evaluation mechanisms, and the cooperative game allows fair negotiation among participants, we combine the cross-efficiency with the cooperative game theory and construct the modified Shapley value to reflect the contribution of the evaluated participant to the alliance. In addition, for each participant, both the optimistic and the pessimistic modified Shapley values are considered, and thus the upper and lower bounds of the allocation revenue are obtained, correspondingly. A numerical example is presented to illustrate the operation procedure. Finally, we apply the approach to an empirical application concerning a city commercial bank with 18 branches in China.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCommon revenue allocation in DMUs with two stages based on DEA cross-efficiency and cooperative game

Xinyu Wang, Qianwei Zhang, Yilun Lu et al.

Shapley Value-based Approach for Redistributing Revenue of Matchmaking of Private Transactions in Blockchains

Yash Chaurasia, Parth Desai, Sujit Gujar et al.

Profit Allocation in the We Media Value Chain: A Shapley Value-Based Approach

Rui Zhang, Jianfei Xu, Junhui Fan

No citations found for this paper.

Comments (0)