Summary

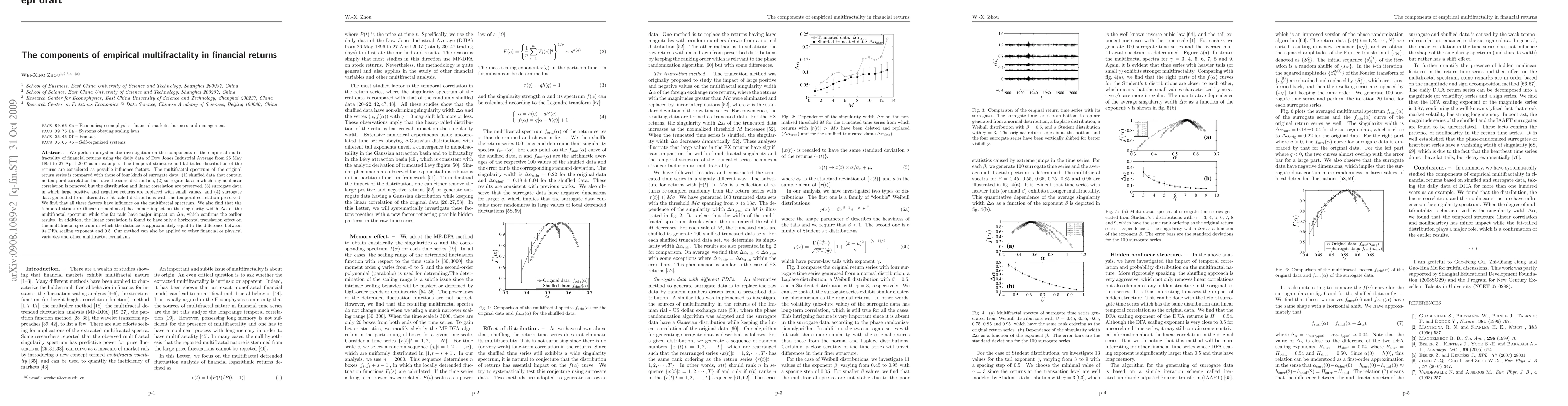

We perform a systematic investigation on the components of the empirical multifractality of financial returns using the daily data of Dow Jones Industrial Average from 26 May 1896 to 27 April 2007 as an example. The temporal structure and fat-tailed distribution of the returns are considered as possible influence factors. The multifractal spectrum of the original return series is compared with those of four kinds of surrogate data: (1) shuffled data that contain no temporal correlation but have the same distribution, (2) surrogate data in which any nonlinear correlation is removed but the distribution and linear correlation are preserved, (3) surrogate data in which large positive and negative returns are replaced with small values, and (4) surrogate data generated from alternative fat-tailed distributions with the temporal correlation preserved. We find that all these factors have influence on the multifractal spectrum. We also find that the temporal structure (linear or nonlinear) has minor impact on the singularity width $\Delta\alpha$ of the multifractal spectrum while the fat tails have major impact on $\Delta\alpha$, which confirms the earlier results. In addition, the linear correlation is found to have only a horizontal translation effect on the multifractal spectrum in which the distance is approximately equal to the difference between its DFA scaling exponent and 0.5. Our method can also be applied to other financial or physical variables and other multifractal formalisms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)