Summary

We consider a discrete-time continuous-space random walk, with a symmetric jump distribution, under stochastic resetting. Associated with the random walker are cost functions for jumps and resets, and we calculate the distribution of the total cost for the random walker up to the first passage to the target. By using the backward master equation approach we demonstrate that the distribution of the total cost up to the first passage to the target can be reduced to a Wiener-Hopf integral equation. The resulting integral equation can be exactly solved (in Laplace space) for arbitrary cost functions for the jump and selected functions for the reset cost. We show that the large cost behaviour is dominated by resetting or the jump distribution according to the choice of the jump distribution. In the important case of a Laplace jump distribution, which corresponds to run-and-tumble particle dynamics, and linear costs for jumps and resetting, the Wiener-Hopf equation simplifies to a differential equation which can easily be solved.

AI Key Findings

Generated Jun 10, 2025

Methodology

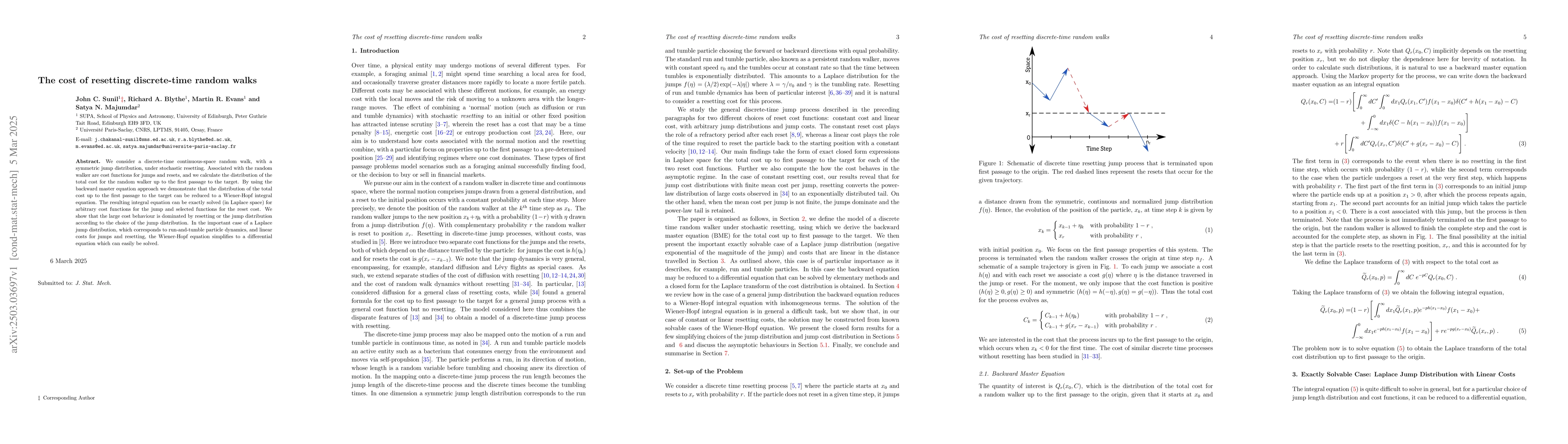

The research extends the framework for calculating the total cost distribution for discrete-time random walks up to the first passage to the target, incorporating resetting. It provides a general expression for the total cost distribution for constant and linear resetting costs, valid for arbitrary jump distributions and jump cost functions.

Key Results

- A general expression for the total cost distribution for constant resetting cost (40) and linear resetting cost (74) was obtained.

- The dominant large cost behavior is determined by the jump distribution.

- For cases with a power-law tail in the jump distribution, resetting does not change the tail behavior to exponential decay but rather maintains the power-law decay.

- Specific examples for Laplace, Gaussian, and Lévy flight jump distributions with various jump and reset costs were analyzed.

Significance

This work is significant as it provides a comprehensive framework for understanding the cost of resetting in discrete-time random walks, which has implications for various fields including biological foraging, search algorithms, and stochastic processes.

Technical Contribution

The paper introduces a detailed analysis using the backward master equation approach and Wiener-Hopf integral equation techniques to solve for the total cost distribution in the presence of resetting.

Novelty

The novelty lies in the comprehensive treatment of resetting in discrete-time random walks, providing exact solutions for various jump distributions and cost functions, and identifying how the large cost behavior is dominated by the jump distribution characteristics.

Limitations

- The analysis primarily focuses on specific jump distributions and cost functions; further exploration is needed for more general cases.

- The study assumes symmetric jump distributions; extending to asymmetric distributions could reveal additional insights.

Future Work

- Investigating other forms of resetting costs beyond constant and linear could provide a broader understanding.

- Exploring the penalty associated with overshooting the target barrier and comparing the effects of resetting on it.

- Extending the results to higher dimensions and multiple time-dependent cost functions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandom walks with stochastic resetting in complex networks: a discrete time approach

Alejandro P. Riascos, Thomas M. Michelitsch, Giuseppe D'Onofrio et al.

Random walks on complex networks under time-dependent stochastic resetting

Hanshuang Chen, Yanfei Ye

No citations found for this paper.

Comments (0)