Summary

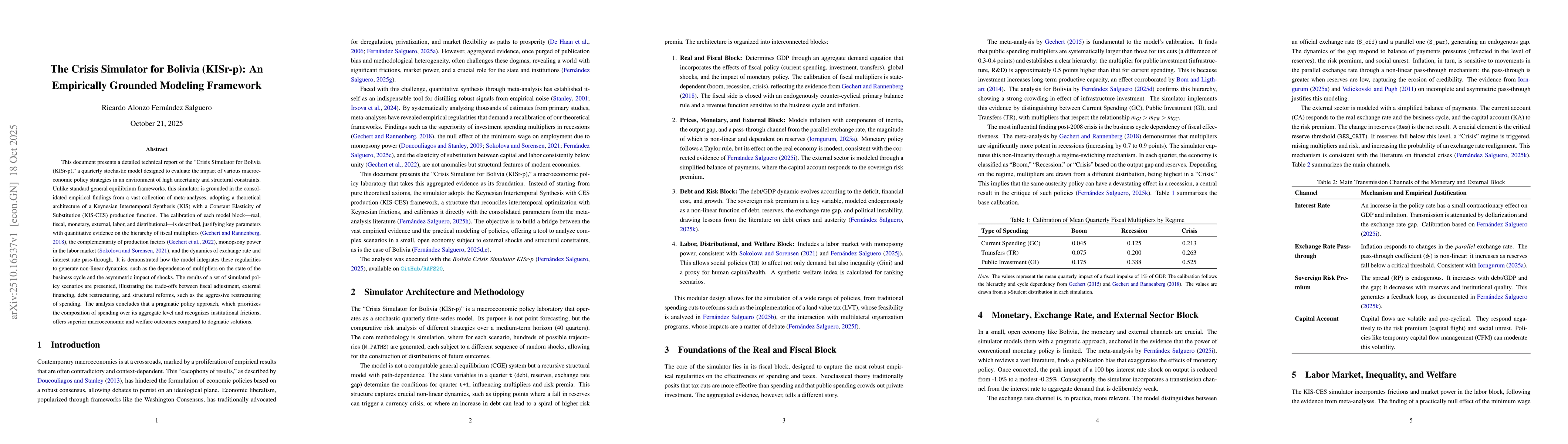

This document presents a detailed technical report of the ``Crisis Simulator for Bolivia (KISr-p),'' a quarterly stochastic model designed to evaluate the impact of various macroeconomic policy strategies in an environment of high uncertainty and structural constraints. Unlike standard general equilibrium frameworks, this simulator is grounded in the consolidated empirical findings of a vast collection of meta-analyses, adopting the theoretical architecture of a Keynesian Intertemporal Synthesis (KIS) with a Constant Elasticity of Substitution (KIS-CES) production function. The calibration of each model block -- real, fiscal, monetary, external, labor, and distributional -- is described in detail, with parameters justified by quantitative evidence on the hierarchy of fiscal multipliers (Gechert and Rannenberg, 2018), the complementarity of production factors (Gechert et al., 2022), monopsony power in the labor market (Sokolova and S{\o}rensen, 2021), and the dynamics of exchange rate and interest-rate pass-through. The model integrates these empirical regularities to generate non-linear dynamics such as state-dependent multipliers, asymmetric responses to shocks, and business-cycle phase interactions. Simulation results highlight the trade-offs between fiscal adjustment, external financing, debt restructuring, and structural reforms -- such as aggressive spending reallocation and targeted public investment. Scenarios show that pragmatic policy approaches that prioritize the \textit{composition} of spending over its aggregate level and that recognize institutional frictions yield superior macroeconomic and welfare outcomes compared to doctrinaire, one-size-fits-all prescriptions.

AI Key Findings

Generated Oct 29, 2025

Methodology

The research employs a systematic review and meta-analysis of existing studies, synthesizing findings from diverse economic and policy analyses to evaluate the impacts of fiscal austerity and structural adjustment programs.

Key Results

- Fiscal austerity is associated with reduced public spending and increased inequality, particularly in developing countries.

- Structural adjustment programs often lead to short-term economic instability but may have mixed long-term growth effects.

- The effectiveness of austerity measures varies significantly based on the economic context and policy design.

Significance

This research provides critical insights into the trade-offs between fiscal discipline and economic growth, informing policymakers on the potential consequences of austerity measures and structural reforms.

Technical Contribution

The study advances the understanding of fiscal policy impacts through a comprehensive meta-analytic framework that synthesizes heterogeneous findings from multiple disciplines.

Novelty

This work uniquely combines economic data with policy analysis to provide a holistic view of austerity's effects, distinguishing between short-term crises and long-term structural changes.

Limitations

- The analysis relies on existing studies, which may have methodological inconsistencies or biases.

- The findings are primarily based on historical data, limiting the ability to predict future outcomes.

Future Work

- Longitudinal studies to assess the long-term impacts of austerity policies on economic development.

- Comparative analyses across different regions and economic systems to identify context-specific effects.

- Integration of qualitative data to better understand the social and political dimensions of austerity measures.

Paper Details

PDF Preview

Similar Papers

Found 5 papersAn Empirically Grounded Reference Architecture for Software Supply Chain Metadata Management

M. Ali Babar, Samodha Pallewatta, Nguyen Khoi Tran

A Keynesian Intertemporal Synthesis (KIS) Model: Towards a unified and empirically grounded framework for fiscal policy

Ricardo Alonzo Fernández Salguero

Comments (0)