Authors

Summary

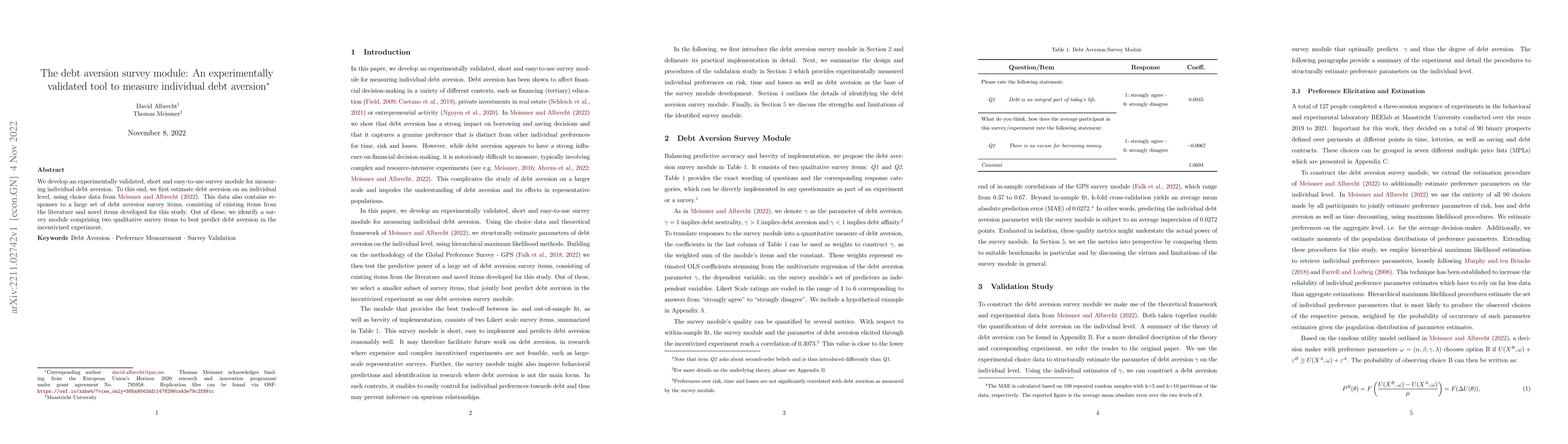

We develop an experimentally validated, short and easy-to-use survey module for measuring individual debt aversion. To this end, we first estimate debt aversion on an individual level, using choice data from Meissner and Albrecht (2022). This data also contains responses to a large set of debt aversion survey items, consisting of existing items from the literature and novel items developed for this study. Out of these, we identify a survey module comprising two qualitative survey items to best predict debt aversion in the incentivized experiment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntertemporal Consumption and Debt Aversion: A Replication and Extension

Thomas Meissner, Steffen Ahrens, Ciril Bosch-Rosa

| Title | Authors | Year | Actions |

|---|

Comments (0)