Authors

Summary

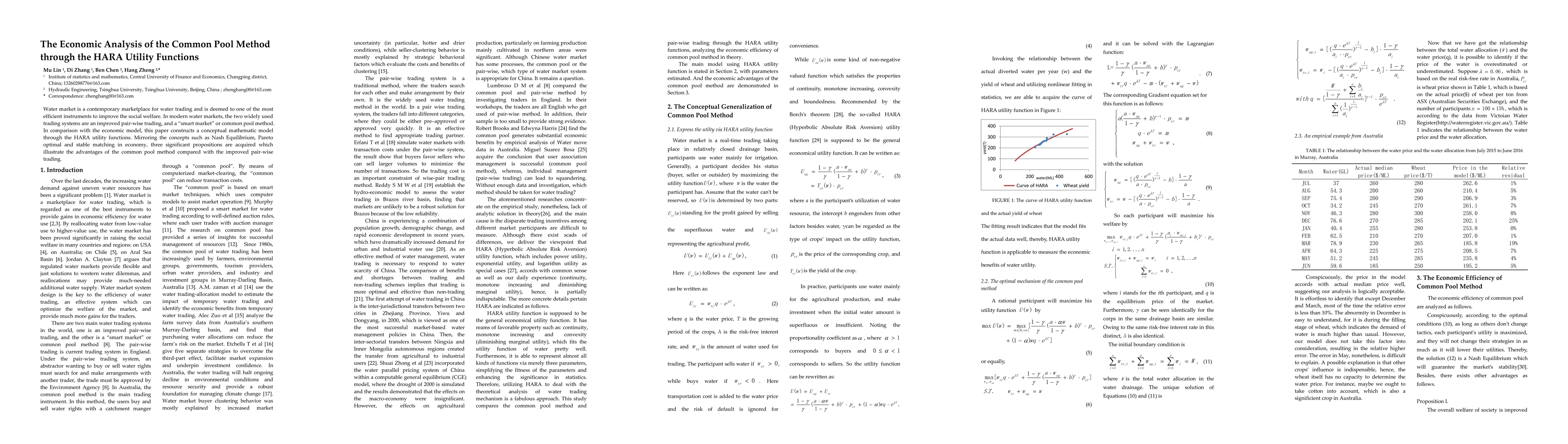

Water market is a contemporary marketplace for water trading and is deemed to one of the most efficient instruments to improve the social welfare. In modern water markets, the two widely used trading systems are an improved pair-wise trading, and a 'smart market' or common pool method. In comparison with the economic model, this paper constructs a conceptual mathematic model through the HARA utility functions. Mirroring the concepts such as Nash Equilibrium, Pareto optimal and stable matching in economy, three significant propositions are acquired which illustrate the advantages of the common pool method compared with the improved pair-wise trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEndowments, patience types, and uniqueness in two-good HARA utility economies

Andrea Loi, Stefano Matta

The role of the Allee effect in common-pool resource and its sustainability

Samir Suweis, Chengyi Tu, Fabio Menegazzo et al.

From Stream to Pool: Pricing Under the Law of Diminishing Marginal Utility

Titing Cui, Su Jia, Thomas Lavastida

| Title | Authors | Year | Actions |

|---|

Comments (0)