Summary

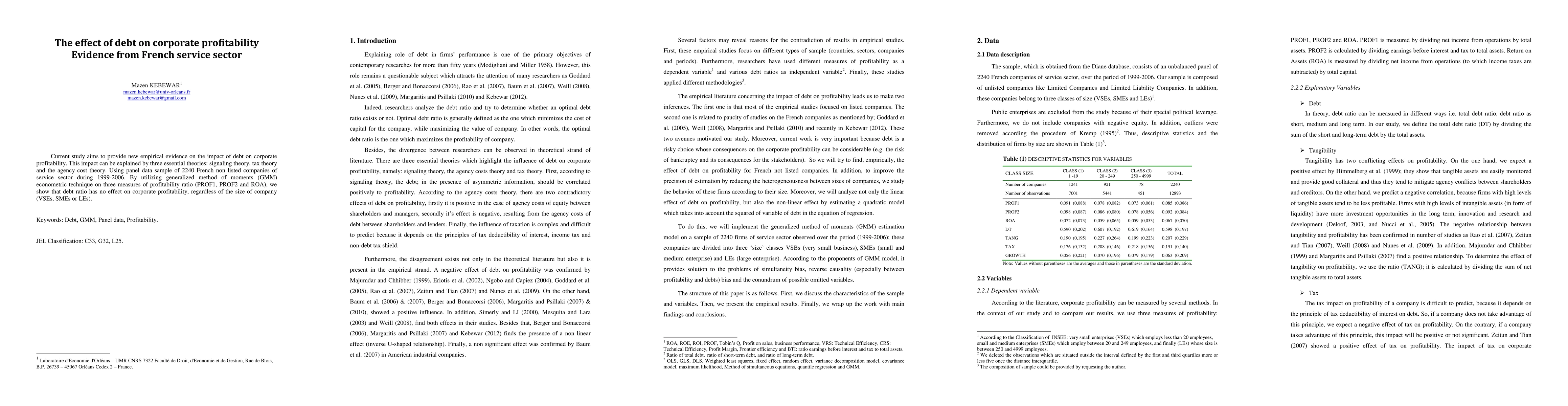

Current study aims to provide new empirical evidence on the impact of debt on corporate profitability. This impact can be explained by three essential theories: signaling theory, tax theory and the agency cost theory. Using panel data sample of 2240 French non listed companies of service sector during 1999-2006. By utilizing generalized method of moments (GMM) econometric technique on three measures of profitability ratio (PROF1, PROF2 and ROA), we show that debt ratio has no effect on corporate profitability, regardless of the size of company (VSEs, SMEs or LEs)

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Effect of External Debt on Greenhouse Gas Emissions

Pablo de la Vega, Jorge Carrera

Equilibrium Defaultable Corporate Debt and Investment

Hong Chen, Murray Zed Frank

| Title | Authors | Year | Actions |

|---|

Comments (0)