Authors

Summary

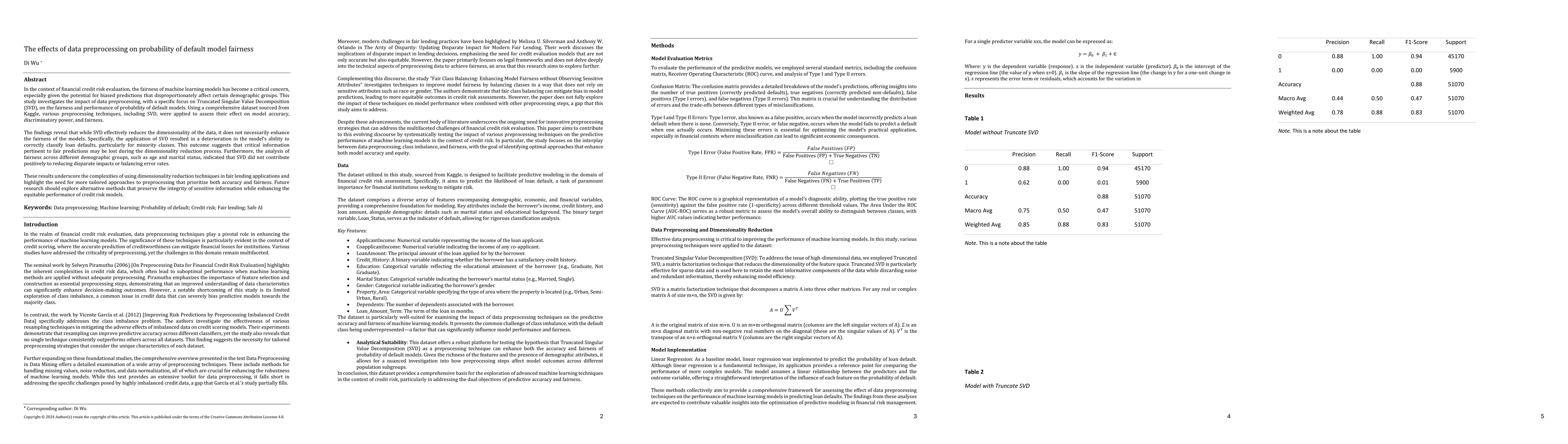

In the context of financial credit risk evaluation, the fairness of machine learning models has become a critical concern, especially given the potential for biased predictions that disproportionately affect certain demographic groups. This study investigates the impact of data preprocessing, with a specific focus on Truncated Singular Value Decomposition (SVD), on the fairness and performance of probability of default models. Using a comprehensive dataset sourced from Kaggle, various preprocessing techniques, including SVD, were applied to assess their effect on model accuracy, discriminatory power, and fairness.

AI Key Findings

Generated Sep 02, 2025

Methodology

The study investigates the impact of data preprocessing, specifically Truncated Singular Value Decomposition (SVD), on the fairness and performance of probability of default models using a comprehensive dataset from Kaggle. Various preprocessing techniques, including SVD, were applied to assess their effect on model accuracy, discriminatory power, and fairness.

Key Results

- Applying Truncated SVD resulted in a reduction in the model's ability to correctly classify loan defaults, particularly for minority classes, across various demographic groups.

- The use of SVD led to a uniform decrease in predictive accuracy and discriminatory power across all demographic groups, failing to achieve the desired balance between accuracy and fairness.

- The model without SVD demonstrated a reasonable capacity to differentiate between defaulters and non-defaulters, albeit with notable inconsistencies across demographic groups.

Significance

This research is important as it highlights the complex relationship between dimensionality reduction techniques and model fairness in credit risk assessment, emphasizing the need for more nuanced preprocessing strategies that balance accuracy and fairness.

Technical Contribution

The paper presents an in-depth analysis of the effects of Truncated SVD on model performance and fairness in loan default prediction, revealing its potential drawbacks in preserving critical information necessary for accurate and equitable predictions.

Novelty

This work stands out by explicitly examining the trade-offs between dimensionality reduction and fairness in credit risk assessment models, providing valuable insights for researchers and practitioners in the field.

Limitations

- The study focuses on a single dataset from Kaggle, which may limit the generalizability of findings to other datasets or contexts.

- The analysis does not explore other dimensionality reduction techniques that might perform better in preserving critical information for accurate and equitable predictions.

Future Work

- Investigate alternative dimensionality reduction methods that could better preserve critical information for accurate and fair predictions.

- Explore the integration of fairness-enhancing techniques with dimensionality reduction to create models that are both accurate and fair across diverse demographic groups.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Learning and Testing of Counterfactual Fairness through Data Preprocessing

Haoyu Chen, Wenbin Lu, Rui Song et al.

FairSHAP: Preprocessing for Fairness Through Attribution-Based Data Augmentation

Lin Zhu, Lei You, Yijun Bian

| Title | Authors | Year | Actions |

|---|

Comments (0)