Summary

We analyze the effects of energy and commodity prices on commodity output using a three-factor, two-good general equilibrium trade model with three factors: capital, labor, and imported energy. We derive a sufficient condition for each sign pattern of each relationship to hold, which no other studies have derived. We assume factor-intensity ranking is constant and use the EWS (economy-wide substitution)-ratio vector and the Hadamard product in the analysis. The results reveal that the position of the EWS-ratio vector determines the relationships. Specifically, the strengthening (resp. reduction) of import restrictions can increase (resp. decrease) the commodity output of exportables, if capital and labor, domestic factors, are economy-wide complements. This seems paradoxical.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

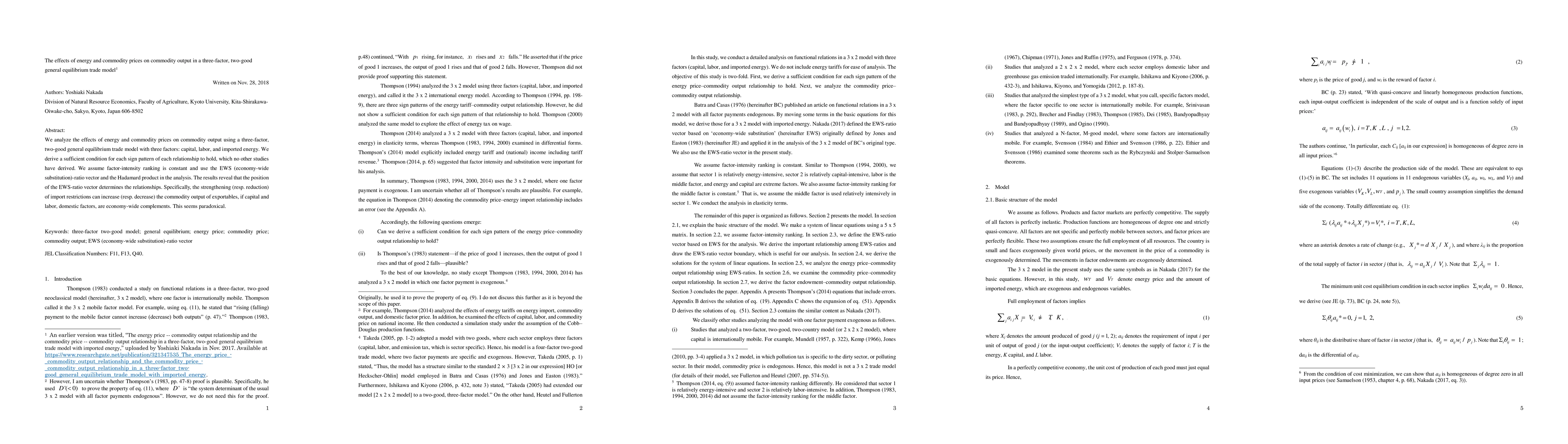

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)