Summary

The aim of this paper is to evaluate geometric Asian option by a mixed fractional subdiffusive Black-Scholes model. We derive a pricing formula for geometric Asian option when the underlying stock follows a time changed mixed fractional Brownian motion. We then apply the results to price Asian power options on the stocks that pay constant dividends when the payoff is a power function. Finally, lower bound of Asian options and some special cases are provided.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper derives a pricing formula for geometric Asian options under a mixed fractional subdiffusive Black-Scholes model, considering time-changed mixed fractional Brownian motion.

Key Results

- A pricing formula for geometric Asian options is obtained under time-changed mixed fractional Brownian motion.

- The model is applied to price Asian power options with constant dividends, where the payoff is a power function.

- Lower bounds for Asian options are provided, along with special cases.

Significance

This research is significant as it extends the traditional Black-Scholes model to incorporate mixed fractional subdiffusion, providing a more realistic framework for pricing Asian options, particularly in markets with long-range dependence and volatility clustering.

Technical Contribution

The paper presents a novel approach for pricing geometric Asian power options using a mixed fractional subdiffusive Black-Scholes model, extending existing literature on fractional Brownian motion in finance.

Novelty

This work introduces a mixed fractional subdiffusive model to price Asian options, which captures more complex stochastic behavior compared to standard fractional Brownian motion models, thus providing a more nuanced pricing framework.

Limitations

- The model assumes constant risk-free interest rate and dividend rate, which may not hold in real-world scenarios.

- The absence of transaction costs in the model might not reflect actual market conditions.

Future Work

- Investigate the impact of time-varying interest and dividend rates on option pricing under this model.

- Explore the effects of transaction costs and other market frictions on option values.

Paper Details

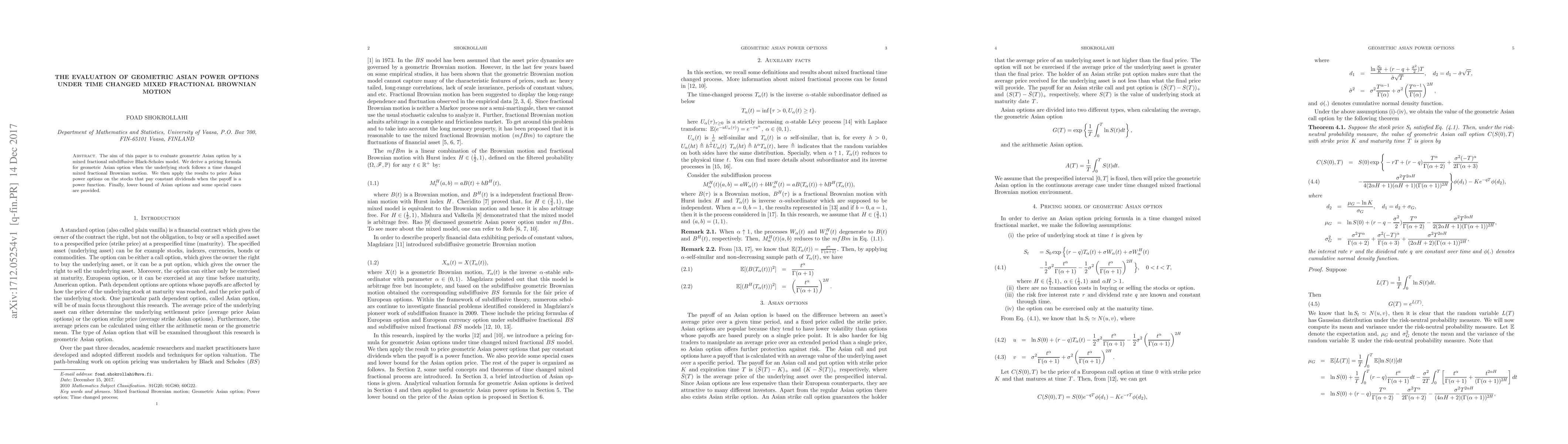

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)