Summary

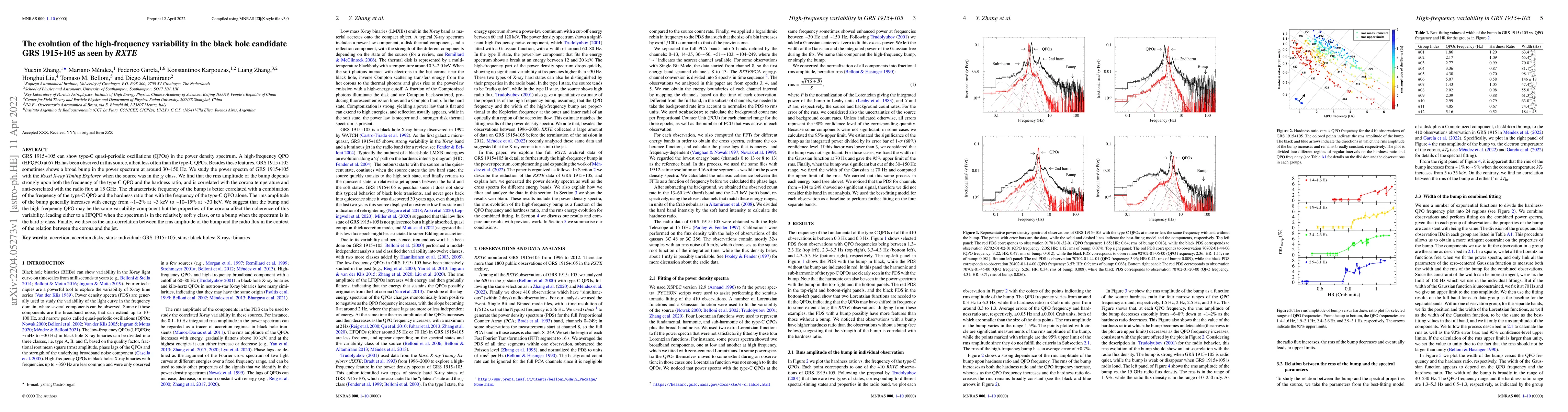

GRS 1915+105 can show type-C quasi-periodic oscillations (QPOs) in the power density spectrum. A high-frequency QPO (HFQPO) at 67 Hz has been observed in this source, albeit less often than the type-C QPOs. Besides these features, GRS 1915+105 sometimes shows a broad bump in the power spectrum at around 30-150 Hz. We study the power spectra of GRS 1915+105 with the Rossi X-ray Timing Explorer when the source was in the $\chi$ class. We find that the rms amplitude of the bump depends strongly upon both the frequency of the type-C QPO and the hardness ratio, and is correlated with the corona temperature and anti-correlated with the radio flux at 15 GHz. The characteristic frequency of the bump is better correlated with a combination of the frequency of the type-C QPO and the hardness ratio than with the frequency of the type-C QPO alone. The rms amplitude of the bump generally increases with energy from ~1-2% at ~3 keV to ~10-15% at ~30 keV. We suggest that the bump and the high-frequency QPO may be the same variability component but the properties of the corona affect the coherence of this variability, leading either to a HFQPO when the spectrum is in the relatively soft $\gamma$ class, or to a bump when the spectrum is in the hard $\chi$ class. Finally, we discuss the anti-correlation between the rms amplitude of the bump and the radio flux in the context of the relation between the corona and the jet.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)