Authors

Summary

Auctions are widely used in exchanges to match buy and sell requests. Once the buyers and sellers place their requests, the exchange determines how these requests are to be matched. The two most popular objectives used while determining the matching are maximizing volume at a uniform price and maximizing volume with dynamic pricing. In this work, we study the algorithmic complexity of the problems arising from these matching tasks. We present a linear time algorithm for uniform price matching which is an improvement over the previous algorithms that take $O(n\log n)$ time to match $n$ requests. For dynamic price matching, we establish a lower bound of $\Omega(n \log n)$ on the running time, thereby proving that the currently known best algorithm is time-optimal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

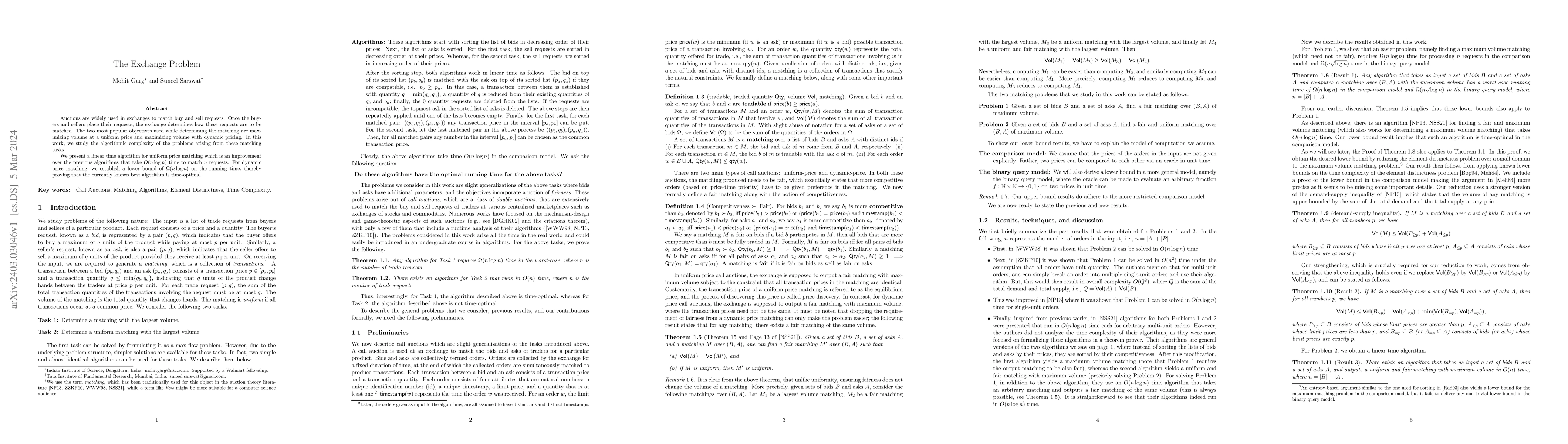

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Telephone Exchange Problem Revisited: A Combinatorial Approach

Sithembele Nkonkobe

No citations found for this paper.

Comments (0)