Summary

A large collection of financial contracts offering guaranteed minimum benefits are often posed as control problems, in which at any point in the solution domain, a control is able to take any one of an uncountable number of values from the admissible set. Often, such contracts specify that the holder exert control at a finite number of deterministic times. The existence of an optimal bang-bang control, an optimal control taking on only a finite subset of values from the admissible set, is a common assumption in the literature. In this case, the numerical complexity of searching for an optimal control is considerably reduced. However, no rigorous treatment as to when an optimal bang-bang control exists is present in the literature. We provide the reader with a bang-bang principle from which the existence of such a control can be established for contracts satisfying some simple conditions. The bang-bang principle relies on the convexity and monotonicity of the solution and is developed using basic results in convex analysis and parabolic partial differential equations. We show that a guaranteed lifelong withdrawal benefit (GLWB) contract admits an optimal bang-bang control. In particular, we find that the holder of a GLWB can maximize a writer's losses by only ever performing nonwithdrawal, withdrawal at exactly the contract rate, or full surrender. We demonstrate that the related guaranteed minimum withdrawal benefit contract is not convexity preserving, and hence does not satisfy the bang-bang principle other than in certain degenerate cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

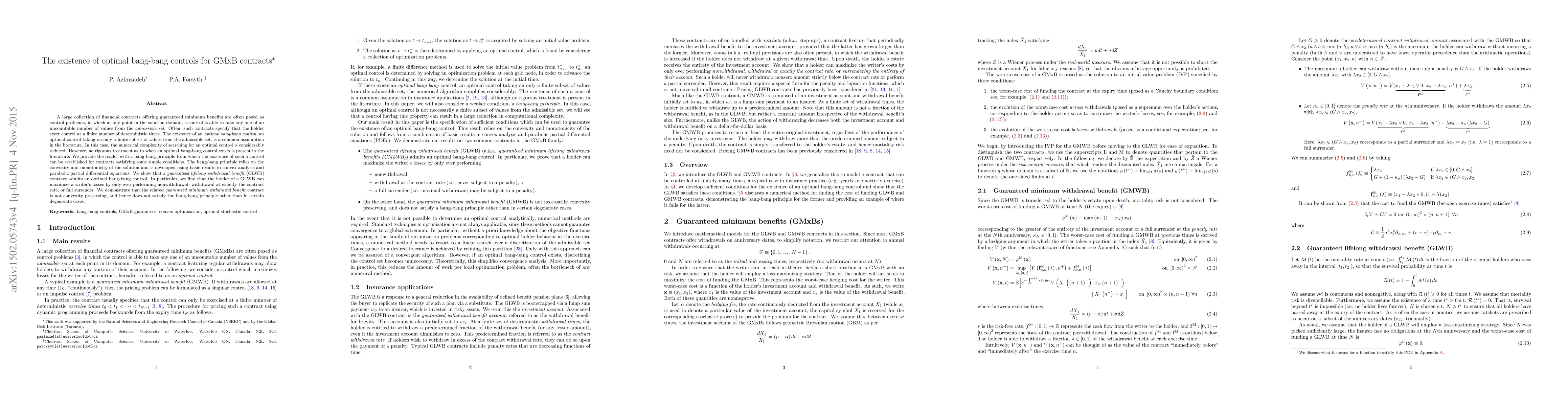

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)