Authors

Summary

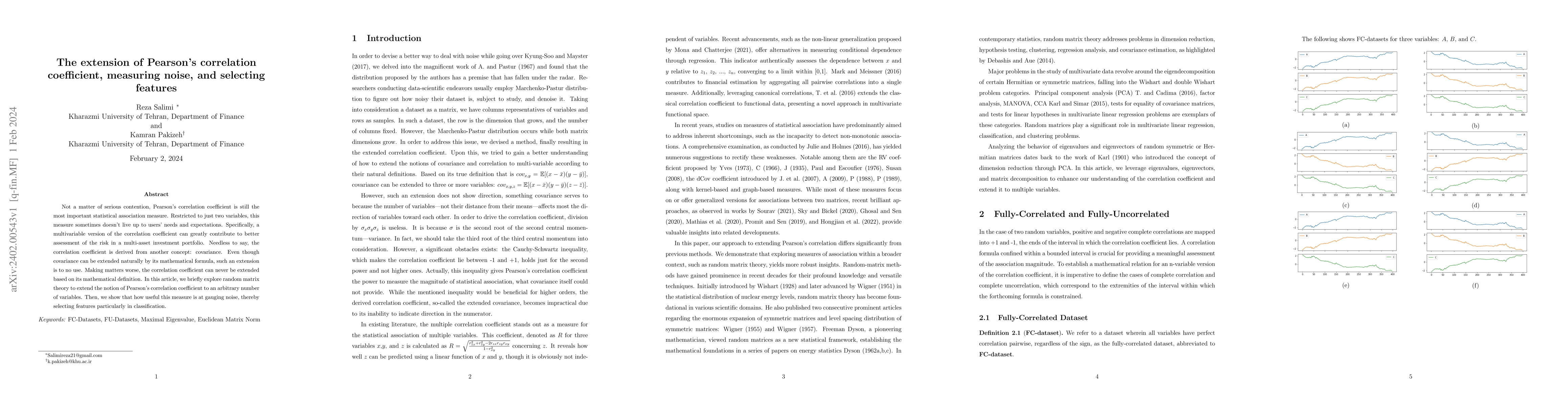

Not a matter of serious contention, Pearson's correlation coefficient is still the most important statistical association measure. Restricted to just two variables, this measure sometimes doesn't live up to users' needs and expectations. Specifically, a multivariable version of the correlation coefficient can greatly contribute to better assessment of the risk in a multi-asset investment portfolio. Needless to say, the correlation coefficient is derived from another concept: covariance. Even though covariance can be extended naturally by its mathematical formula, such an extension is to no use. Making matters worse, the correlation coefficient can never be extended based on its mathematical definition. In this article, we briefly explore random matrix theory to extend the notion of Pearson's correlation coefficient to an arbitrary number of variables. Then, we show that how useful this measure is at gauging noise, thereby selecting features particularly in classification.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPKD: General Distillation Framework for Object Detectors via Pearson Correlation Coefficient

Jian Cheng, Ke Cheng, Yifan Zhang et al.

No citations found for this paper.

Comments (0)