Summary

In this paper we provide a novel family of stochastic orders that generalizes second order stochastic dominance, which we call the $\alpha,[a,b]$-concave stochastic orders. These stochastic orders are generated by a novel set of "very" concave functions where $\alpha$ parameterizes the degree of concavity. The $\alpha,[a,b]$-concave stochastic orders allow us to derive novel comparative statics results for important applications in economics that cannot be derived using previous stochastic orders. In particular, our comparative statics results are useful when an increase in a lottery's riskiness changes the agent's optimal action in the opposite direction to an increase in the lottery's expected value. For this kind of situation, we provide a tool to determine which of these two forces dominates -- riskiness or expected value. We apply our results in consumption-savings problems, self-protection problems, and in a Bayesian game.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

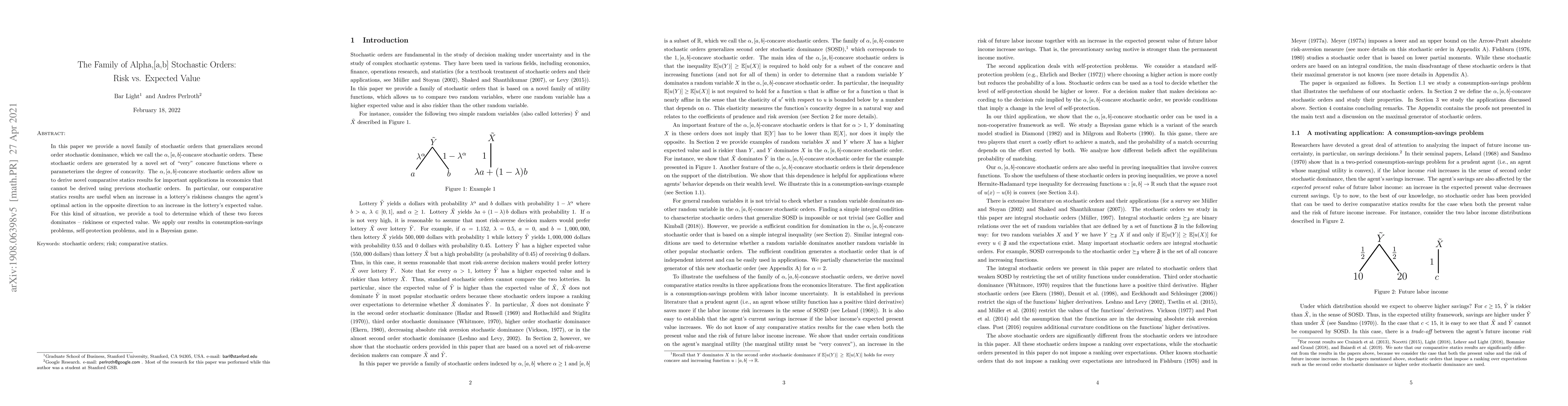

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Multilevel Stochastic Approximation Algorithm for Value-at-Risk and Expected Shortfall Estimation

Noufel Frikha, Stéphane Crépey, Azar Louzi

Asymptotic Error Analysis of Multilevel Stochastic Approximations for the Value-at-Risk and Expected Shortfall

Noufel Frikha, Stéphane Crépey, Azar Louzi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)