Summary

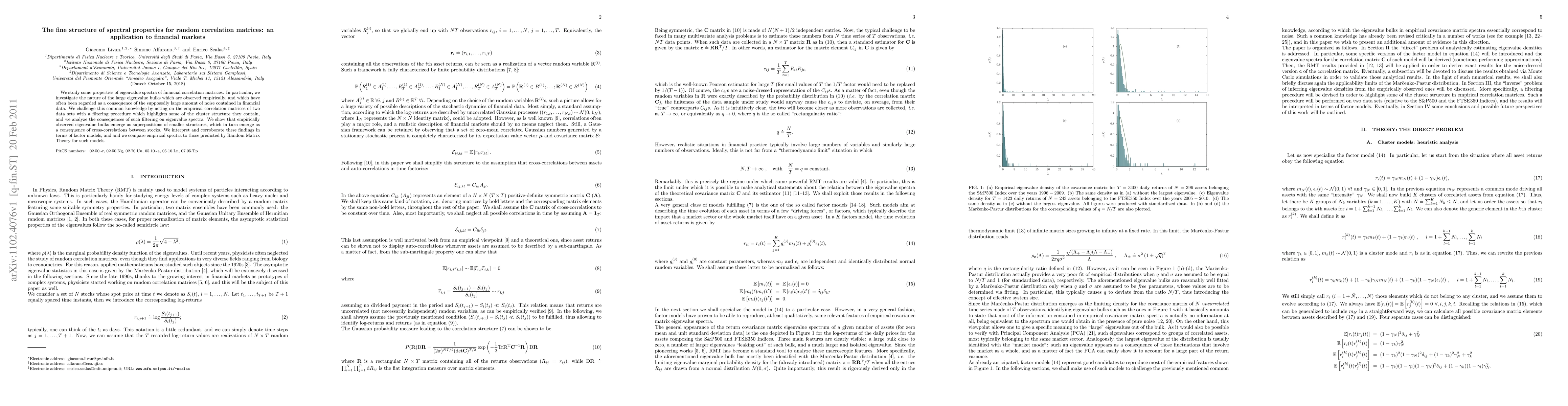

We study some properties of eigenvalue spectra of financial correlation matrices. In particular, we investigate the nature of the large eigenvalue bulks which are observed empirically, and which have often been regarded as a consequence of the supposedly large amount of noise contained in financial data. We challenge this common knowledge by acting on the empirical correlation matrices of two data sets with a filtering procedure which highlights some of the cluster structure they contain, and we analyze the consequences of such filtering on eigenvalue spectra. We show that empirically observed eigenvalue bulks emerge as superpositions of smaller structures, which in turn emerge as a consequence of cross-correlations between stocks. We interpret and corroborate these findings in terms of factor models, and and we compare empirical spectra to those predicted by Random Matrix Theory for such models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)